“Davidson” submits:

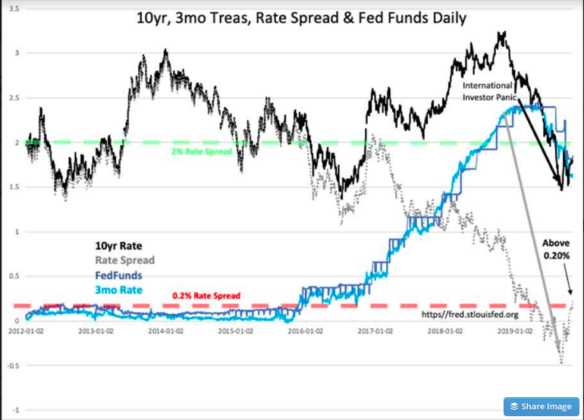

Rate watchers are holding their breath and with crossed fingers hoping for a Federal Reserve FFunds rate reduction believing this stimulating to economic activity. Fed rate history has long shown that the Fed led T-Bill rates only once since 1953. This single period of Fed proactive rate shift occurred under Paul Volker to counter inflation-spending psychology in the early 1980s. Other than this period, the Fed has followed T-Bill rate shifts with a lag of up to a month. With T-Bills having declined close to 1.6%, 0.28% below the mid-range of FFunds at 1.88%, we should expect Chair Powel to lower FFunds by 0.25% based on his previous adjustments. Fed rate changes are always neutral as they track rates already established by market forces.

More important is what is occurring in the T-Bill/10yr Treasury rate spread. Since the yield curve inversion June 2019 with the spread turning negative, the spread fell to a negative -0.51% early Sept 2019, but has since become positive by 0.25% as of today. A rate spread level of 0.20% has been the historical benchmark for dramatic changes in bank lending. Falling below 0.20% in this spread has always been associated with past slowdown in lending activity while rising above this level with lending expansion. This is the basis for investors viewing rising 10yr Treasury rates as bullish for equities. The facts of lending are a widening positive spread is positive for equities which is what we see today.

Multiple economic indicators have remained in positive trends the past 24mos while investor psychology turned towards various levels of pessimism. Barron’s released its money manager poll on Saturday with the lowest level of optimism in 20yrs. https://www.barrons.com/articles/barrons-big-money-poll-why-wall-street-is-scared-of-washington-51572045878

The signs point to a positive shift in market psychology. I expect FANG issues to remain out of favor while the historical dividend paying issues regain market prominence.