“Davidson” submits:

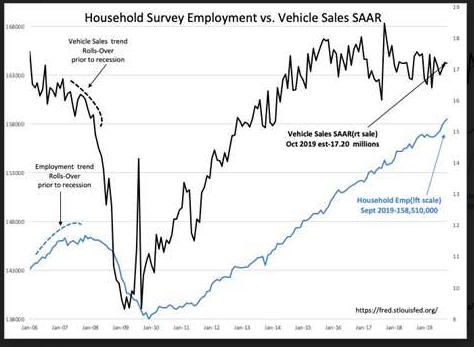

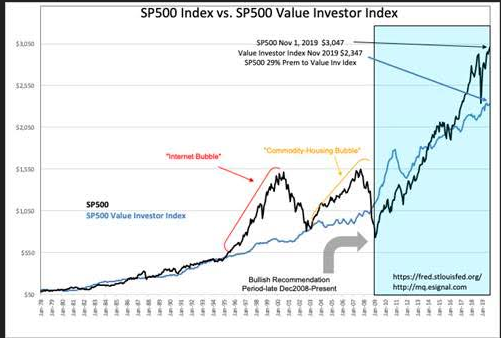

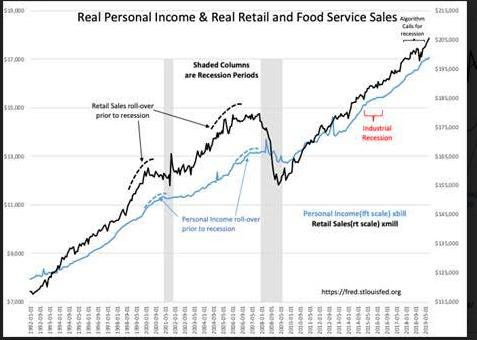

US Household Survey reported a rise of 241,000 while vehicle sales estimates appear to be holding steady. Real Personal Income recorded a new high. The Dallas Fed reported the 12mo Trimmed Mean PCE at 2.06% which showed a revised and slightly higher trend which leads to the SP500 being a premium of ~29% to the SP500 Value Investor Index.

There continues to be no sign of rollover in key economic indicators signaling potential recession in our future. As noted in earlier commentary, the strong US$ has stalled US manufacturing activity which is reflected in a stalled Chemical Activity Barometer(CAB) and stalled Job Openings but the Trucking Tonnage Index(TTI) and Real Retail Sales remain in decent uptrends.

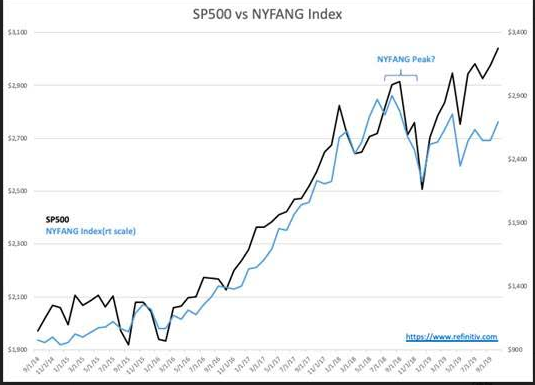

Despite many continued forecasts for recession with some claiming a recession has begun, there are no signs of economic weakness supporting this perspective. Equity markets have been in correction mode since Jan 2018 mainly due to the belief that FANG issues had stalled. The NYFANG index comprises ~25% of the market cap of the SP500 and appears to have peaked in 2018. However, dividend growth issues known as Value Stocks appear to be gaining.

Equity markets should rise as pessimism eases us away from recession fear.