“Davidson submits:

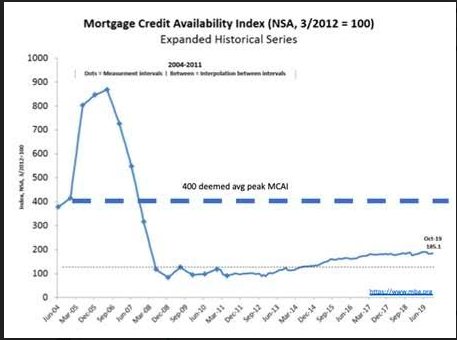

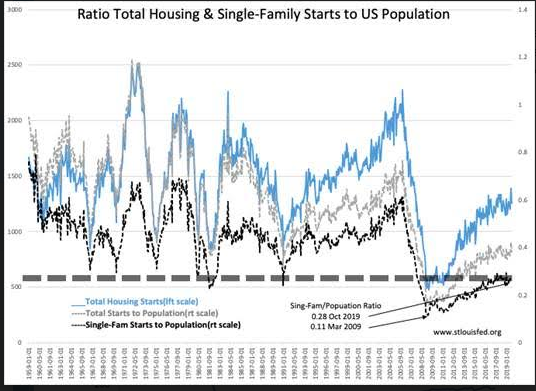

Identifying the evolving policy shifts with the US Housing market is important in anticipating the impact to economic activity. The MCAI Index(Mortgage Credit Availability Index) introduced in 2012 with inception date of Jan 2004 captures the impact of the Sub-prime lending speculation in 2005-2006, the collapse in 2007-2009 and subsequent Dodd Frank legislation. Housing is normally thought to be ~20% of US GDP but since Dodd Frank it has been closer to ~15% with historically low Single-Family Housing construction. Lending has been severely restricted from past levels (MCAI – 400 level deemed normal for a period of economic expansion). At the peak of Sub-prime lending the MCAI surged almost to 900.

Government policies are important especially so if they impinge on the US financial system. We have experienced 3 major government programs to ‘eliminate poverty’ since 1913. Each had a topsy-turvy impact on perceived US financial stability with an average timeframe of 17+yrs. Pres Wilson’s lending to poor farmers begun in 1913 gave us the Great Crash of 1929 and subsequent Great Depression, Pres Johnson’s Great Society (and other programs) gave us the 1970’s Great Inflation ending with Fed Chair Volcker’s actions of back-to-back recessions in 1981-82 and last was Pres Clinton’s Community Reinvestment Act in 1995 which ended with the Sub-prime Crisis in 2008-2009 and the Great Recession. Politically the party in office is blamed at the time of each financial crisis even though the seeds were sown several administrations prior.

In the blame-game of political partisanship, we have never understood the root cause of these events. Without historical perspective some have labeled these collapses as unfathomable ‘Black Swans”. With perspective, each can be attributed to a shift towards ‘poor underwriting standards’ which infiltrated the US financial system. This eroded established equity valuations unobserved till the impact of these policies suddenly ballooned into view.

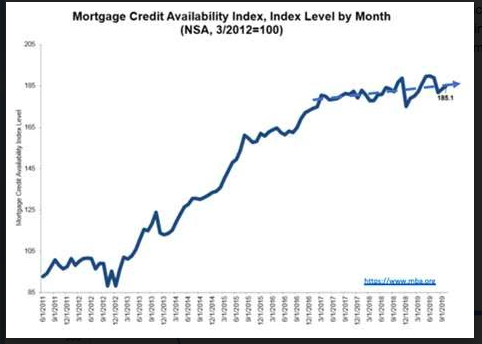

The response to the most recent crisis was Dodd Frank(DF) legislation. Net/net DF made lending to first time home buyers a much higher hurdle. As a result, multi-family housing which is supported by commercial lending grew in prominence leaving the Single-Family housing/Population Ratio today at the recession lows since 1959(0.28). Today the MCAI at 186 remains less than half the 400 level deemed normal for an economic expansion at this point in the cycle. Newly minted college graduates with decent employment income, if they had educational debt, have typically seen rejection as first time home buyers. While the current administration has lowered Fed regulations by 30%+ per the decline in the Federal Register, only recently has it introduced policies to loosen regulations for first time home buying. The slight improvement in the MCAI from the decline reported in Sept is hopeful but the trend remains sluggish and uncertain until newer regulations have impact.

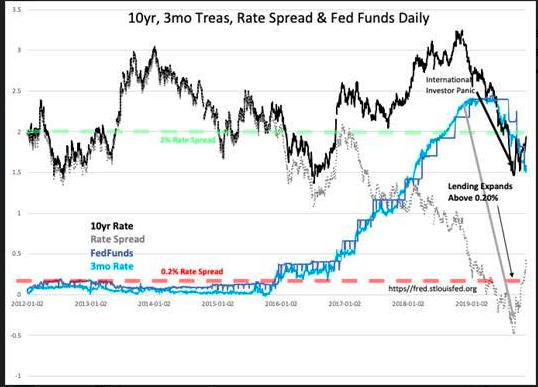

Meanwhile, mortgage lending also saw a decline due to the yield curve inversion July-Sept 2019. Today, this is in the process of reversing. The yield curve inversion is heavily interpreted as a sign of pending recession as it reduces lending activity. However, we know that the yield curve inversion is more due to capital exiting China seeking a safe haven in 10yr Treasuries due to the US/China tariff initiatives than it is to overall economic weakness which remains decently robust.

The current economic environment is very dynamic if anything. Making predictions becomes a wait and see process till new lending regulations begin to have impact. Should first-time home buying begin to accelerate, the positive impact for the US economy would be significant. Existing conditions remain on track for economic expansion as they have been since this cycle began in 2009.