“Davidson” submits:

Investors Bail on Stock Market Rally, Fleeing Funds at Record Pace”

In what may be the best year for stocks since 2013, investors have exited in droves

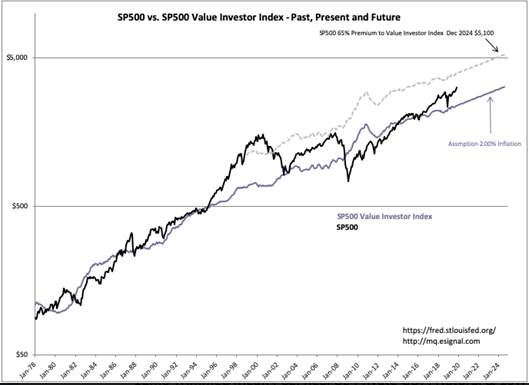

The SP500 Value Investor Index has been updated and extended to 2024. Currently the SP500 is priced at a 31% premium to the Value Investor Index(VII). Market prices are a reflection of market psychology in response to reported earnings. This means that market psychology can price equities above or below the VII, derived from fundamental long-term GDP and SP500 EPS trends, dependent on future expectations. The VII is based on Knut Wicksell’s 1898 description of the “Natural Rate”.

The VII is simply a fundamental guideline against which an investor can roughly benchmark market prices. An SP500 below the VII is a level attractive to those who call themselves Value Investors. Market history since 2000 which has seen increasing use of price-trend algorithms indicates the potential of the next market peak near a 65% premium to the VII if algorithms remain as strong an influence as they have been recently. With emerging policy initiatives to reduce regulations and global tariffs, it is likely the current economy may extend for several more years. The 65% premium level to the VII has been extended to Dec 2024. The SP500 potential for the current cycle Dec 2024 is $5,100.

An estimate of this type should be taken with multiple caveats:

- The economic expansion must continue to 2024.

- Investors must routinely under estimate economic activity such that new reports result in higher and higher equity prices

- Inflation remains stable at 2%–(higher inflation lowers VII)

The current level of market psychology remains fairly cautious as measured by sideline cash and sentiment indicators. Even so the SP500 is a 31% premium to the VII. The market never tops till the majority of investors shift into optimism and or outright speculation. The 10yr Treasury rate relative to the VII is a good measure relative market psychology. Strongly positive market psychology is accompanied with rising 10yr rates as investors sell fixed income to invest in equities. Market peaks in 1981, 1987, 2000 and 2007 had 10yr rates either above or close to the Natural Rate. Today the Natural Rate is 4.93% while market fears have the 10yr Treasury rate in the 1.8% range. There is significant capital residing today in low-return fixed income which is likely to shift into equities should this cycle continue as anticipated. This is how markets become over-valued at a 65% premium to the VII.

1.8% 10yr Treasury rates indicate market pessimism. History shows that markets always peak with a significant shift of capital from fixed income to equities in a bout of speculation.

A 10yr rate much closer to the Natural Rate of ~5% is necessary before this cycle enters a speculative top.

Current market conditions reflect overly pessimist investors. The conditions necessary for a cycle top are:

- Market psychology must be overly optimistic or even speculative

- Both T-Bill and 10yr Treasury rates must be rising sharply as capital moves into equities with the rise in T-Bill rates causing a yield curve inversion

- The SP500 at a 31% premium in today’s pessimistic environment, means we are likely to see a 65% premium as in the two prior market peaks.

With rates falling and 10yr Treasury rates revisiting historic lows last seen in 2011, the current market still reflects a high level of pessimism much like that seen in every recession since 1953. This is a ‘Mind over Matter’ situation and in stark contrast to key hard-count economic indicators of Employment, Personal Income, Retail Sales and etc which remain in the same uptrends since 2009.

Coming out of this market psychology condition and finally recognizing the magnitude of economic strength this cycle continues to deliver should result in dramatically higher equity prices.