I still maintain we may be in store for considerably higher oil prices in 2020…

“Davidson:” submits:

$WTI has been rising since August 2019 after many negative economic forecasts and belief that we remain in oversupply with expectations prices should decline. It is believed by many that too much supply will keep prices down and perhaps even force mid-$40s/BBL $WTI. Frackers are spoken of as their own enemy producing more than is in their own interests. That there has been and remains considerable misperception in the quid pro quo of Supply/Demand vs Prices is a gross understatement.

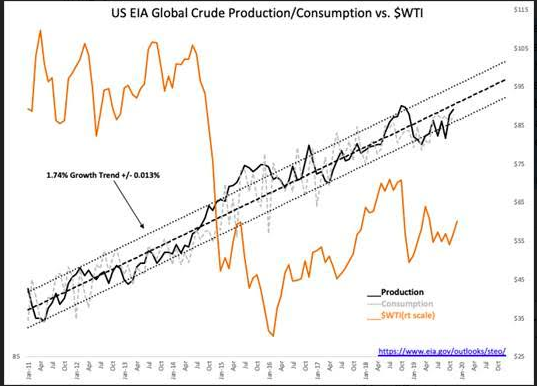

The US EIA’s data of Global Crude Production/Consumption vs. $WTI reveals that there is no significant impact on Production or Consumption vs. Price being tightly balanced since 2011. Oil pricing is not simple. Price dynamics are based more on market psychology than on swings in economic demand. Making understanding even more difficult is the fact that price drivers have evolved from one factor to another over time. That $WTI has been correlated to inflation has long been accepted.

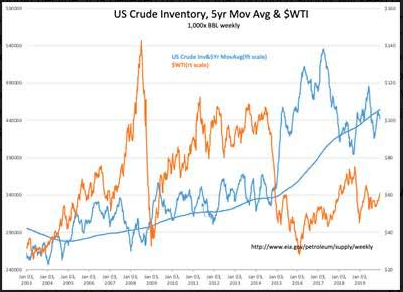

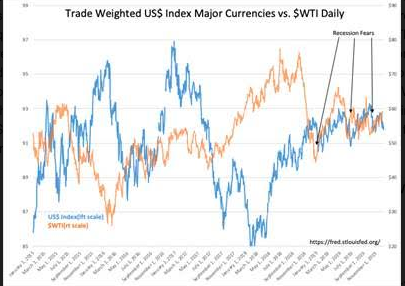

Since 2003, there developed a strong inverse relationship with the US$(US Dollar) in 2014-2016 that has become less important the past 18mons. In its place, $WTI has been more sensitive to perceptions of economic activity and the yield curve. Even more important, traders have focused on current inventories vs. their 5yr mov avg.