“Davidson” submits:

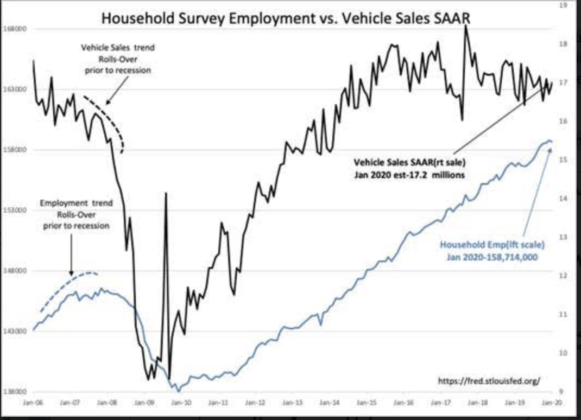

US Household Employment Survey which is the most statistically comprehensive measure of employment in the US including the self-employed and not counted by any other measure, dropped from last month’s level of 158,803,000 to 158,714,000 or fell 89,000. The Establishment Survey reported a rise of 225,000 with past months revised higher by 7,000. The Household Survey revises past data annually while the Establishment Survey revises past months on a monthly basis. Part of the Establishment Survey commentary is shown. Traders make adjustments to positions on each Establishment Survey report mostly ignoring revisions to previous month’s data. Trading on data which one knows is inaccurate seems nonsensical, but that is part and parcel of the market place.

https://www.bls.gov/news.release/empsit.nr0.htm

“Establishment Survey Data

Total nonfarm payroll employment increased by 225,000 in January, compared with an

average monthly gain of 175,000 in 2019. Notable job gains occurred in construction,

in health care, and in transportation and warehousing.

In January, construction employment rose by 44,000. Most of the gain occurred in specialty

trade contractors, with increases in both the residential (+18,000) and nonresidential

(+17,000) components. Construction added an average of 12,000 jobs per month in 2019.

Health care added 36,000 jobs in January, with gains in ambulatory health care services

(+23,000) and hospitals (+10,000). Health care has added 361,000 jobs over the past 12 months.

Employment in transportation and warehousing increased by 28,000 in January. Job gains

occurred in couriers and messengers (+14,000) and in warehousing and storage (+6,000).

Over the year, employment in transportation and warehousing has increased by 106,000.

Employment in leisure and hospitality continued to trend up in January (+36,000). Over

the past 6 months, the industry has added 288,000 jobs.

Employment continued on an upward trend in professional and business services in January

(+21,000), increasing by 390,000 over the past 12 months.

Manufacturing employment changed little in January (-12,000) and has shown little movement,

on net, over the past 12 months. Motor vehicles and parts lost 11,000 jobs over the month.

Employment in other major industries, including mining, wholesale trade, retail trade,

information, financial activities, and government, changed little over the month.

In January, average hourly earnings for all employees on private nonfarm payrolls rose by

7 cents to $28.44. Over the past 12 months, average hourly earnings have increased by

3.1 percent. Average hourly earnings of private-sector production and nonsupervisory employees

were $23.87 in January, little changed over the month (+3 cents). (See tables B-3 and B-8.)

The average workweek for all employees on private nonfarm payrolls was unchanged at 34.3

hours in January. In manufacturing, the average workweek remained at 40.4 hours, while

overtime edged down 0.1 hour to 3.1 hours. The average workweek of private-sector production

and nonsupervisory employees edged up by 0.1 hour to 33.6 hours. (See tables B-2 and B-7.)

The change in total nonfarm payroll employment for November was revised up by 5,000 from

+256,000 to +261,000, and the change for December was revised up by 2,000 from +145,000 to

+147,000. With these revisions, employment gains in November and December combined were

7,000 higher than previously reported. (Monthly revisions result from additional reports

received from businesses and government agencies since the last published estimates and from

the recalculation of seasonal factors. The annual benchmark process also contributed to the

November and December revisions.) After revisions, job gains have averaged 211,000 over the

last 3 months.”

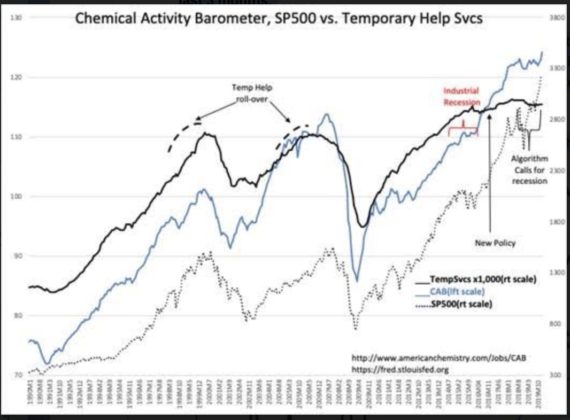

With economic data investors should only be concerned with long-term trends. The Household Survey remains on the same trend since 2009. Temporary Help, an indicator of demand for labor, after stalling for a period with a period of US$(US Dollar) strength, appears to have turned higher along with the Chemical Activity Barometer(CAB). The CAB, measuring manufacturing in the industrial sector, established a record high last month.

Economic expansion continues on trend. Equity prices should continue higher as investor psychology turns more positive.