“Davidson” submits:

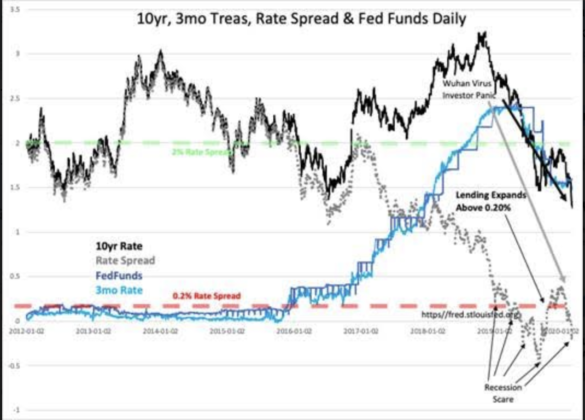

A combination of events produces a new historic low for US 10yr Treasury rate at 1.27%. Many interpret plunging to low rates as reflecting economic Armageddon, but with record US employment solidly in a rising trend, US consumer/commercial/credit card default rates near 17yr lows, rising retail sales and rising personal income coupled to rising Chemical Activity Barometer(CAB) and rising Trucking Tonnage Index(TTI) there is far more going on than a simple rate trend interpretation captures. The much larger story involves US policies to rebalance global trade relationships in the midst of sanctioning multiple autocratically lead countries’ attempts to under-cut property rights of their own citizens.

You can blame the iPhone for educating the world for much of this messiness. The iPhone was introduced in 2007 and rapidly gained acceptance globally as a device which let holders have access to all globally available information sources. The effect was that individuals under governments more distant from Democratic principles could now see they had other options available than they had previously been aware. The iPhone is credited as the driving force behind a series of anti-government protests referred to as the “Arab Spring” in 2010. Citizens who had become aware that they could have better standards of living demanded their voices be heard by their leaders. As the iPhone gained acceptance, Western investors entered and created liquid investment marketplaces in these same countries seeking higher returns. Many companies became publically traded entities and many owners, previously having all their assets illiquid, now had liquid wealth beyond what they had thought possible. Now that their businesses were incorporated into the global investment platforms, they gained simultaneous access to Western investment opportunities.

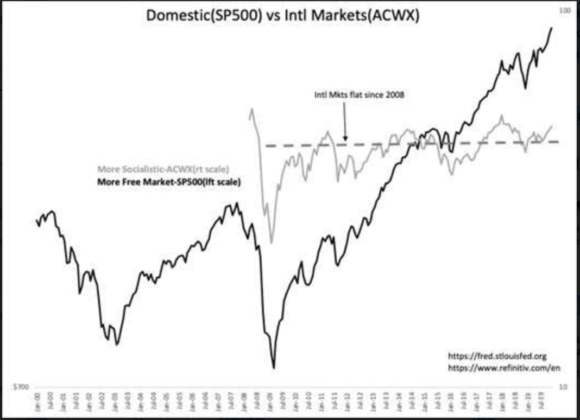

Unfortunately, the belief of Westerners that Democratic principles would follow the development of Emerging Markets was misplaced. Since 2008 with the earlier introduction of a host of new market indices, Morgan Stanley created the MS All Capitalization World Index ex US(ACWX). This index demonstrates that the growth Western investors anticipated has not occurred. We can now look back at the performance of global markets and identify that US markets as represented by the SP500 has vastly out-performed all other markets. The basis for this is that the US operates by Free Market rules under the US Constitution. All other markets have higher levels of government control. Free Markets are based on freedom of individual choices determining the flow of societal innovation offered and the freedom of individual choice to buy or not buy any particular innovation. Individual make their own assessment of the value to their own standard of living. Individual’s are the final arbiters of the pace and direction of innovation in a Free Market, not government policy. The US Constitution’s Amendments 1-5, guarantee free speech, assembly, self-determination, individual physical and innovation property rights and self-defense. These rights are refreshed everyday in the legal system and every once in a while when government oversteps, a single individual can negate an entire government program as in Schechter Poultry vs United States, 1935. https://en.wikipedia.org/wiki/A.L.A._Schechter_Poultry_Corp._v._United_States

The aspects of a Free Market have become so culturally embedded that we routinely take it for granted and do not teach nor even recognize the value this confers. Likewise, we take it for granted that it follows us as a normality where ever we go and as individuals we are shocked to find ourselves confronted by authoritarian governments. The tragedy of this is that we are suddenly pulled-up short by incidents such as what occurred to Otto Warmbier 2017 in No. Korea https://en.wikipedia.org/wiki/Otto_Warmbier. Citizens of other countries recognize these differences as observed by Hernando de Soto Polar in “The Mystery of Capital: Why Capitalism Triumphs in the West and Fails Everywhere Else”, 2000. The arguments being made today of Socialism vs. Capitalism began with Karl Marx in the 1860s, but can be traced to Socrates, 470-399 BC, who articulated the benefits of top-down autocratic government to order society. Claude-Frédéric Bastiat described the proper role of government in “The Law”, 1850. One of the most articulate of modern economic philosophers has been Friedrich Hayek who authored “The Road to Serfdom”, 1944 and “The Fatal Conceit”, 1988. The comparison of the SP500 vs AWCX, data not available when Bastiat, Hayek and de Soto Polar made their observations, is proof of how innovative and productive the US Free Market is vs. various forms of ‘Top-Down” government controlled economies.

Within the broad context of globalization, Western investors have liquefied ~$24Trillion of GDP in Emerging Markets with little change to their respective government’s over-reach. Western equity capital used to create the Emerging Market platform. In hindsight, using the Natural Rate benchmark based on Knut Wicksell’s observations published in 1898, as these markets became capitalized some of this capital was being sent back to Western Sovereign debt and real estate beginning in ~2000.

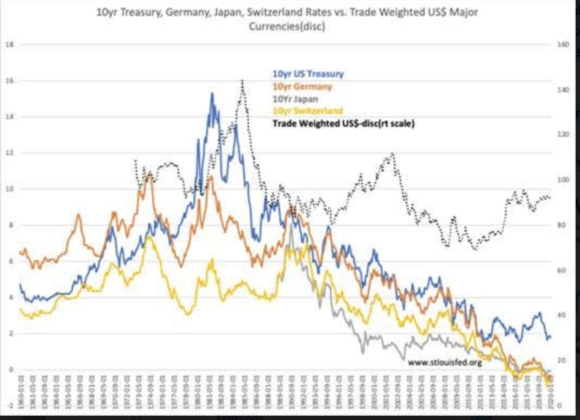

There are periods of US$(US Dollar) strength. Those periods coincide with periods when the US represented higher global returns. Today’s US$ strength represents a similar period. US policy initiatives lowering tax & regulatory burden and lowering global tariffs has shifted the US economy higher. This is occurring in a period when autocratic governments post greater risks to native capital. Global investors, since 2007, have had access via the iPhone(or smartphone) to every information source and every capital market. The global system is so large and diverse that most of this capital transfers without obvious evidence. Lately though, we have been able to watch daily shifts in currencies correlated to 10yr US Treasury rates as headlines drive investor sentiment.

Some Western countries have experienced negative Sovereign Debt rates. There should be no surprise that smaller nations have issued less Sovereign Debt. A smaller debt issuance means that the country’s 10yr debt cannot absorb the pressure of the capital flow. Even at negative rates in a new currency, shifting Emerging Market capital still receives a positive return if the originating currency is declining. There have been many currency declines lately relative to the safest markets in Europe and the US. With US policies the past 3yrs to lower regulations, taxes, boost economic activity and rebalance tariffs to make trade more equal, capital transfers to the US have accelerated making many trading benchmarks based on the 10yr rate no longer relevant.

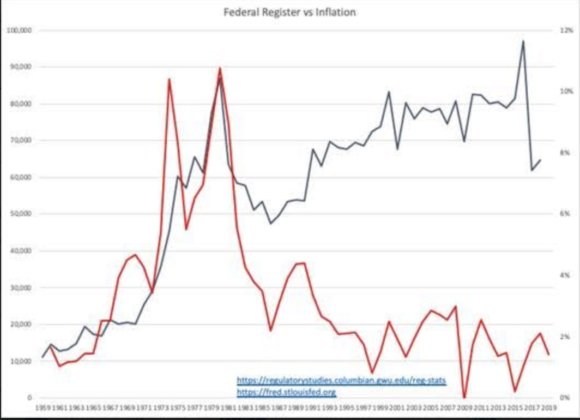

US 10yr Treasury rates falling to 1.27%, lowest in a 5,000yr rate history, while US economic activity posts records is the result of the global ubiquity of the iPhone. Low rates are a sign of individuals exercising Free Market decisions which the iPhone and globalization of information and capital markets foster. The history of the Federal Register regulation reduction under Pres Reagan has a strong correlation with falling inflation and expanding economic activity. This correlation is common sense. Taxes and regulation raise the costs to business and consumers. Bastiat, Hayek and de Soto Polar saw this. Lower taxes and regulations provides not only lower costs to consumers, but it lowers inflation and accelerates introduction of innovation. Acceleration of innovation contributes to even lower inflation. The reduction in regulations has a positive multi-year impact. Current reductions have only just been implemented. The US is the most attractive economy globally and capital is flowing in response.

Less Regulation (Taxation) = Lower costs to Innovation = Better Value to Consumers = Lower Inflation = Raises Pace of New Innovation-Fosters even lower Inflation = Higher Returns

Globally every investor knows, now due to the iPhone, that the US is the best marketplace for capital. IPhones let investors transfer capital with a few swipes. This is Democracy in process. Even though we have historic low rates today in what appears to be a response to a global catastrophe of a new coronavirus, the bigger picture indicates that capital is coming to where capital is treated best.

A reversal of the current panic is near. In my opinion, low rates are being wildly misread. The low rates today are simply a continuation of global investors favoring Free Markets with the coronavirus scare adding another push out of countries which have not treated their citizens well. In my judgement, Free Market activity has already developed an anti-viral drug called remdesivir which shows signs of successfully treating the latest viral threat. Gilead developed this drug to treat Ebola, but while effective in monkeys it was not effective in humans. This drug has shown effectiveness against coronavirus and appears to be successful treating recent illnesses. Free Markets foster fecund innovation and often have hidden solutions to unexpected problems. China has ramped production for use domestically.

Free Markets are the best environments for innovators, produce the greatest advances in standards of living, produce wealth for innovators and promote continuation of Democratic principles. Free Markets find the most efficient solutions to unexpected threats. Eventually, we will see the iPhone as one of the most innovative creations ever experienced by mankind similar to discovery of how to make fire and the wheel.

This is a time to add to portfolios. Not a time to panic as so many are doing today.