“Davidson” submits:

The basics of markets is that they reflect market psychology and our expectations for the future. Investment markets are exchanges where investors price anticipated changes in the value of equities, fixed income securities, commodities and etc as well as a myriad of derivative securities used by investors to hedge/speculate on expectations. Investors fall into two basic categories, Momentum Investors and Value Investors.

Momentum Investors make decisions relying on price trends as their primary indicator. They believe that prices reflect all that is publically known and privately known about the investment. They are short-term holders with trading frequently correlated by price trends to levels Value Investors view as representing economic nonsense. The “Internet Bubble” excess in the late 1990s is often seen as one of these Momentum driven periods. In reality, price-trend driven excesses of various securities occur frequently. If one looks for them, you will see them every month and be surprised at how often price-trend followers get caught up chasing prices.

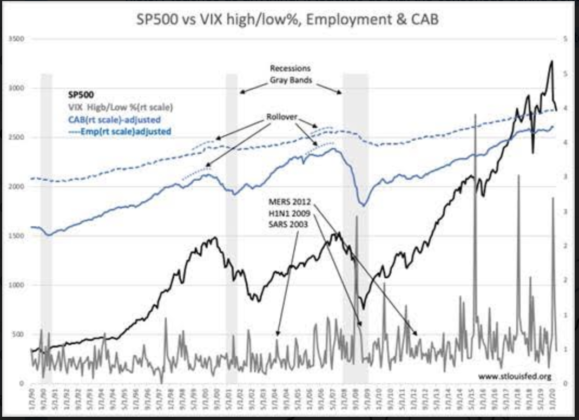

Value Investors take a different approach. They rely on identifying whether prices represent under- or over-valuation relative to long term economics and business fundamentals. Their approach is to buy investments which are overly discounted to fundamentals and sell those which are excessively priced. Value Investors are often sellers of investments Momentum Investors view as having developed strong uptrends and worth buying and vice versa. While Momentum Investors believe that prices predict economic activity, Value Investors view prices as simply reflecting consensus market psychology. Value Investors track economic trends using hard counts of employment, personal income, retail sales, goods manufactured and transported. The ‘Market’ usually presented as having one perspective in the media is anything but. What creates confusion for most is that the media primarily presents the Momentum Investor perspective. Their rapid change of opinion based on price-trends makes for better entertainment than the far less frequent opinion changes of Value Investors. These differences in opinion can be seen in periodic market panics the last 30yrs. Recession predictions due to market volatility have been estimated as 9x more frequent than actual recessions. Much like today.

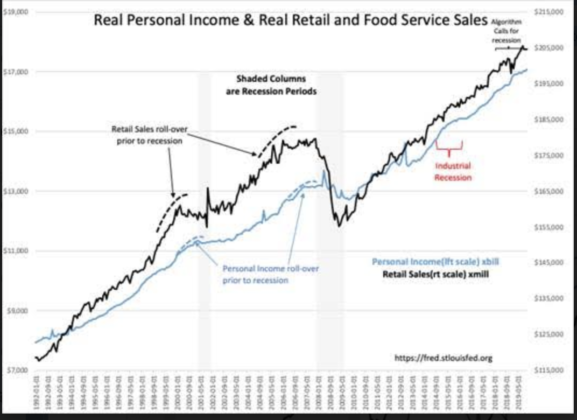

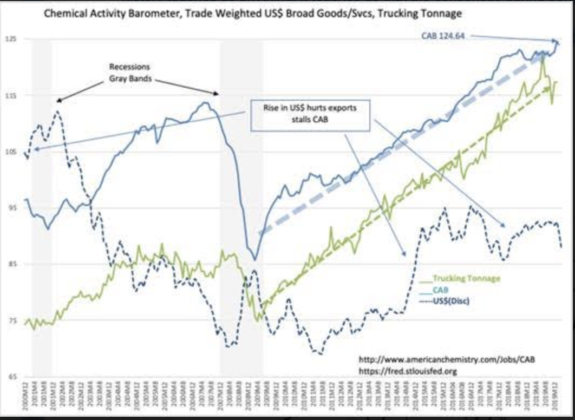

30yrs of history of the SP500 is correlated to the VIX(Volatility Index), the CAB(Chemical Activity Barometer) and Employment(Household Employment) from Jan 1990,. There are many spikes in the VIX each of which represents a short period of market pessimism. Each spike represents Momentum Investors turning pessimistic. Global virus pandemics were part of the mix, but there were multiple geopolitical and economic surprises believed to be meaningful which were not in fact so. Note well, not once has a VIX spike predicted a recession. Spikes occur only after recessions become more widely recognized. What did forecast recessions were meaningful rollovers of hard-count employment, goods production and transport indices such as the CAB & TTI(Trucking Tonnage Index), personal income and retail sales. Economic indicators have always provided early warnings, as much as 2yrs, prior to the onset of recessions and well before market tops.

Understanding the differences between Momentum vs Value Investing is critical if one wishes to make sense of the investment process. Every market is different from the past. The Momentum Investors whose algorithmic trading is based on Modern Portfolio Theory(MPT), 1952, expect past patterns to be repeated mathematically to guide future investment decisions. Today, Momentum Investors use the inverted yield curve as a recession signal when rates have evolved away from reflecting economic returns. Rates today more reflect the economic fears Emerging Market-based investors have regarding home-grown autocratic leaders. That mathematics and MPT are not equipped to incorporate what amounts to differing cultural investment biases is not recognized. Yet, algorithmic trading is more than 50% of daily trading activity.

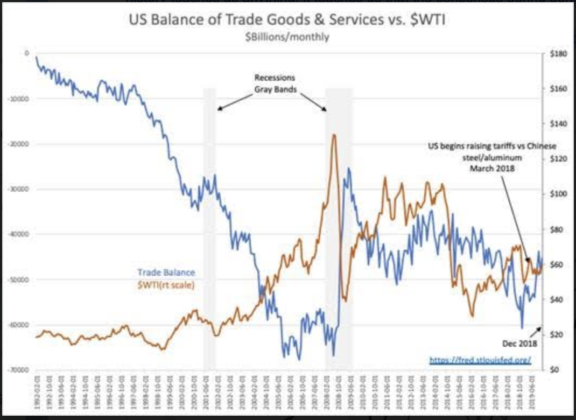

Evolving economic factors impacting the US Balance of Trade and recent trends in the US$ provide a useful lesson. The correlation of the US Balance of Trade and $WTI(West Texas Intermediate Oil Price) reflects US trade deficits from unbalanced tariff regimes relative to the US. The US Balance of Trade has been in decline since prior to 1992 At the time of the 2008-2009 Recession, the US was a significant oil importer. Oil prices(again a psychology based indicator) fell with equities which led to a Balance of Trade improvement. Today, conditions are significantly changed. The US due to ‘Fracking’ is now energy independent. The collapse of $WTI in 2014 had far less impact as US oil imports had in importance. The recent improvement in the US Balance of Trade since Dec 2018 is due to the impact of recent US tariff rebalancing initiatives. That the US is exporting more can be seen in the recent surge in the CAB, the steady rise in TTI, retail sales, personal income and employment. The US is a global supplier of chemicals and higher-value plastics derived from crude oil and natural gas. Combined with reductions in regulations and greater availability of low cost raw materials, the US is producing and exporting more as tariff regimes rebalance. In the rush to deliver simplified 20 second attention getting media commentary, a more detailed analysis combining these multiple interacting themes never receive airing. What we mostly hear is opinion based on price-trends self-influenced by those who do not understand economic fundamentals. These pundits give commentary thinking that prices make these predictions.

Economic activity constantly flows forward incorporating always incorporating new policies and global themes not previously present. Momentum Investors only recognize new trends after enough of a price-trend is reflected in their models. Global capital shifts impacting US rates and values in REIT(Real Estate Investment Trusts) can be detected at least 10yrs ago. The earliest detection with additional hindsight suggests these capital shifts began in the late 1990s, more than 20yrs ago. With a short-term trading dynamic, Momentum Investors do not detect broad economic themes. Add to their short-term highly leveraged approach, the elimination of the ‘Uptick Rule’ in 2007 which slowed Momentum Investor-based market destabilizing short selling, we have the VIX’s wild swings since. Every spike in the VIX underlined an imagined fearful outcome rather than actual economic trends as they evolved. There are likely fewer than 5% of forecasters the past 2wks who have called for continued economic expansion in the face of the current VIX spike. If history teaches us anything, it teaches us that the consensus during periods such as these has always been wrong.

Corporate insiders, deemed the best informed Value Investors, are registering nearly 300 buys daily. This is well above the 100/Day benchmark and a very sound indicator

Buy equities! Economic expansion continues.