“Davidson” submits:

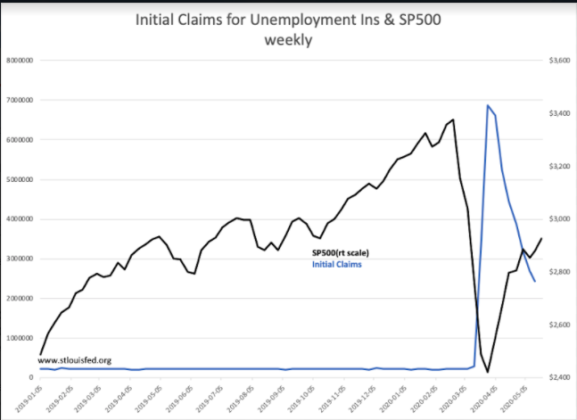

While predictions continue to be dire, the Initial Claims for Unemployment Insurance have fallen by more than 60% in a rapid decline from the March 23rd report. In addition, prior reports have been revised lower with last week’s report in particular revised 290,000 lower. Even though the accumulated unemployment level is approaching 15%, it is in the slowing pace of Initial Claims that investors perceive light at the end of the tunnel. There is a 50yr history correlation with markets rising once the peak in Initial Claims has occurred.

With many states rapidly reversing ‘shelter-at-home’ orders, the run on supermarkets for food and other supplies has slowed dramatically. The shift towards normalization has been underpinned by the response of the our supply chain to restock quickly which raised confidence that supplies would be available when needed. Equity prices and oil prices have turned higher this morning in response to this morning’s Initial Claims report.

The recommendation continues to be buy stocks of long-term well-managed companies which remain ignored in the current environment.

Also:

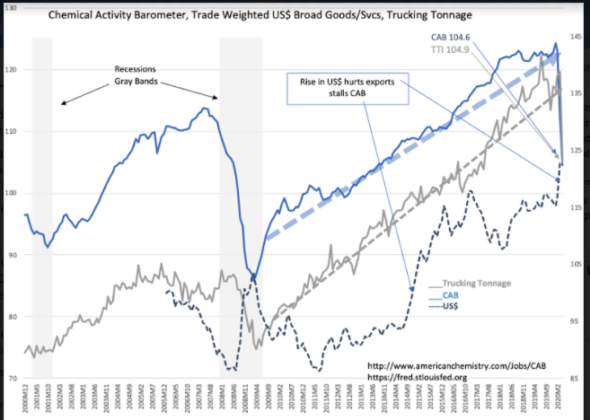

The Trucking Tonnage Index(TTI) has matched last month’s drop in the Chemical Activity Barometer(CAB). Initially, there was a flurry of trucking activity to restock grocery shelves as consumers panicked by media reports regarding death rates from COVID-19 and government orders to shelter-at-home raided supermarkets. This activity offset the weakness in other aspects of the sudden down turn reflected initially in the CAB(a manufacturing index). Now that things have settled in a bit with less frenzy at supermarkets, the TTI reflects what the CAB indicated month earlier.

With Initial Claims for Unemployment Insurance having peaked March 23rd and the Crude Oil Situation showing that this industry has adjusted rapidly to the nationwide shutdown, we have already seen moves to normalize our lives in the Apple Mobility data. The TTI and CAB, while good indicators, lag 1 or 2mos and do not reflect the rapid change to the better in anecdotal reports. I expect we will see these turn rapidly higher the next 2-3mos as states reopen their economies.