“Davidson” submits:

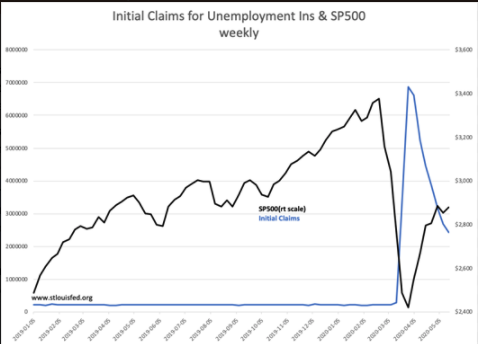

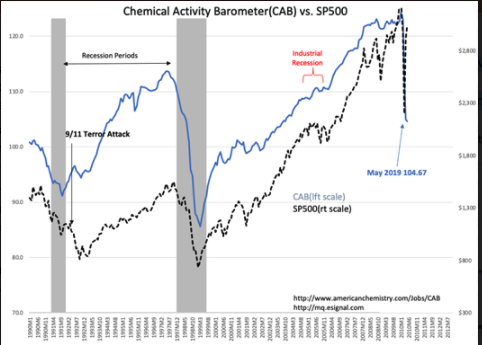

The question is “How do you know the market is near a bottom?” No one can ever know with absolute certainty because market prices are determined by market psychology at the time. A good example was 9/11, the same month the Chemical Activity Barometer(CAB) turned higher, but market psychology turned more negative even though the 200 recession was a few months behind us. Barring an event which spooks investors, the revised CAB appears to bottom and supports what is shown in the Initial Claims for Unemployment Insurance. The Initial Claims data has a 1wk lag while the CAB report represents 1mo of data.

Nonetheless, these fundamental indicators are good signals of economic improvement and correlate with lows in the SP500 if no other headlines spook investors into a mistaken sell off which occurred due to 9/11. There will always be uncertainty regarding how investors respond to events, but if not overly swayed, investors tend to push equity prices as recovery is observed in economic indicators with Initial Claims and CAB being good examples.

The US economy is recovering and equity and oil prices are rising in concert in response to the lack of additional ‘Bad News”. There remain many sound investment opportunities as Momentum-type Issues lead the rise. The insider buying remains in Value-type issues and it these issues which represent the better management skills and fundamental values.

Buy equities where insiders have been the most active buyers.