“Davidson” submits:

Investing is about buying skilled management not products. Investing is about anticipating future events ahead of other investors so that capital can be deployed to take advantage of price shifts due to changes in market psychology. Attempting to do this with an assessment of a company’s product line vs competitors has always found analysts lacking in the insights required to differentiate between the value propositions offered which more often than not are determined by consumers after introduction to a competitive marketplace. Gilead’s(GILD) introduction of a Hepatitis C cure is one of the classic unanticipated successes in market history. Management is always the most knowledgeable of their offering potential with the better managements letting markets determine product success. Touting loudly one’s competitive advantage and potential profitability prior to introduction of a new offering is the equivalent of challenging competition to quickly copy and destroy that competitive advantage. The better managements do not advertise innovations till they have become established in a competitive market which helps them to continue to thrive once initially positioned. For investors, it is best to anticipate the future by a focus on management’s past success not the current headline.

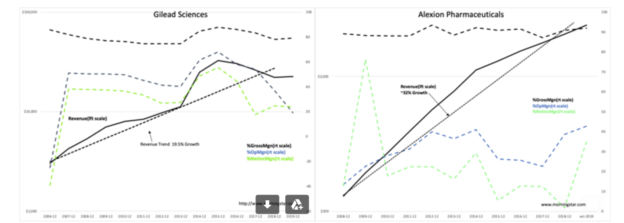

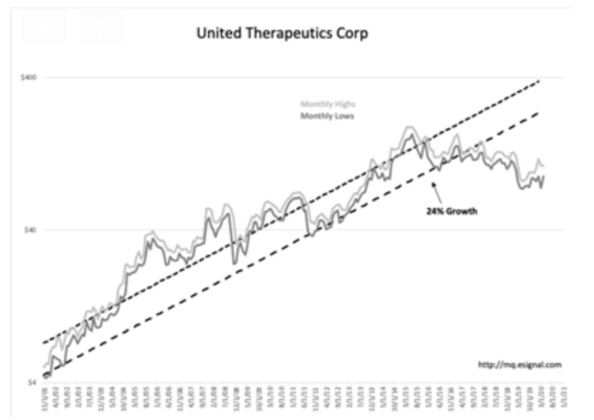

With this in mind, Gilead(GILD), United Therapeutics(UTHR) and Alexion Pharmaceuticals(ALXN) are reiterated as portfolio suggestions. GILD has been much in the news with its potential treatment Remdesivir for COVID-19 while UTHR and ALXN not as much. The Morningstar financials are shown in chart form. Growth in each came from internal research combined with a series of astute acquisitions which complemented and extended product offerings. Each has an exceptional history of success. Recent quarterly reports support progress in various efforts likely to lead to positive surprises.

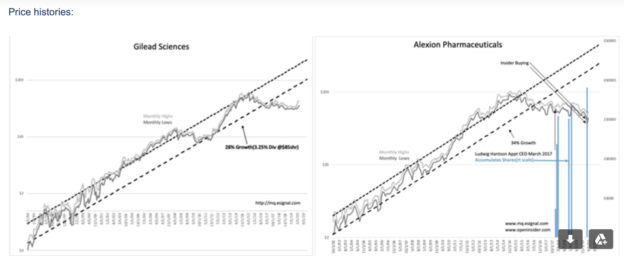

Each company’s stock prices rides the trends of market psychology which are often driven by Momentum Investor trading algorithms. Currently, shares reflect a general period of pessimism while managements at each company continue to produce new treatments and maintain long-term revenue growth and business margins. That the recent price histories seem almost identical reflects in part the ebb and flow of market psychology and the growing use of ETFs by Hedge Fund Momentum Investors. Each company is trading at or near the lowest Price/Sales ratio recorded the past 10yrs. These are exceptional histories of revenue growth. Prices today are at significant discounts to historical pricing and to other pharma companies. It is anticipated that each will introduce innovative products which reignite investor enthusiasm. Investing in these issues requires patience and trust that management is likely to repeat past innovation even as innovation remains unpredictable.

These companies do not have a history of insider buying, but ALXN has a pattern of CEO accumulation via stock grants and Baker Brothers, a well-regarded biopharma investor, which now must report as an insider.

Morningstar financial histories in chart format: