“Davidson” submits:

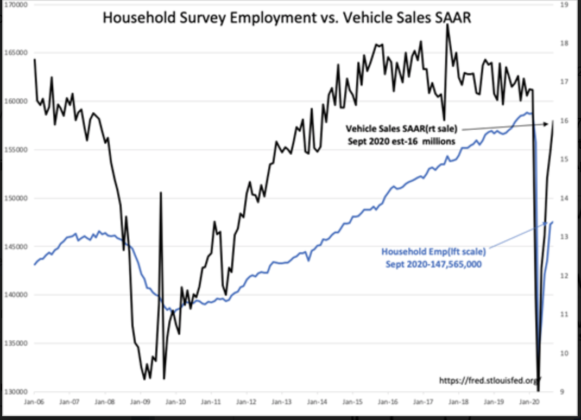

Household Survey Employment is reported higher by 275,000 and Light Weight Vehicle Sales SAAR(Seasonally Adjusted Annual Rate) rises to an est ~16mil. Both of these economic indicators thus far reflect a “V” shaped economic recovery since April lows.

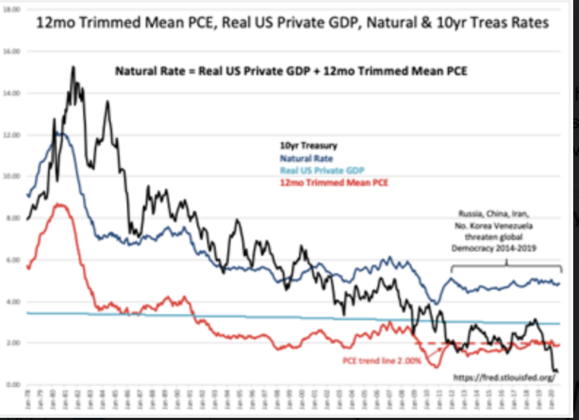

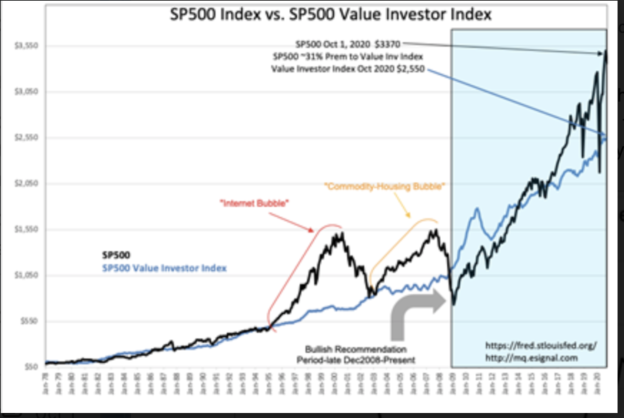

The Dallas Fed reports the 12mo Trimmed Mean PCE(Inflation) at 1.92%. This is a trending inflation measure that is routinely revised impacting last 4mos of readings slightly. It is used to calculate the ‘Natural Rate’ combined with the long-term US Real Private GDP trend that in turn is used to price the relative historic value of the SP500 earnings also derived from its long-term trend. The pricing of the SP500 as a premium or discount to the Value Investor Index is purely fundamental. It is important to recognize that property protections underwrite economic growth in the US. As long as property protections in place since 1933 do not change, then the Value Investor Index is helpful. Recent government policy shifts, less government regulation and lowered tariffs with trading nations, have strongly improved individual property protections for US innovators.

The most impactful and least recognized economic stimulus at work today has been Federal reduction in regulations which has lowered costs to businesses, lowered inflation, expanded opportunities for innovation, raised employment and wages at a faster pace than last witnessed when Pres Reagan did the same in mid-1980s. Federal Register vs Inflation chart available on request.

Currently, the SP500 is priced at a 31% premium to the Value Investor Index. Major market pricing at economic peaks have been in the 65%-100% premium range. Market pricing is driven by market psychology and is not precise, but periods of excess optimism and pessimism tend to repeat past levels of the SP500 relative to the Value Investor Index.

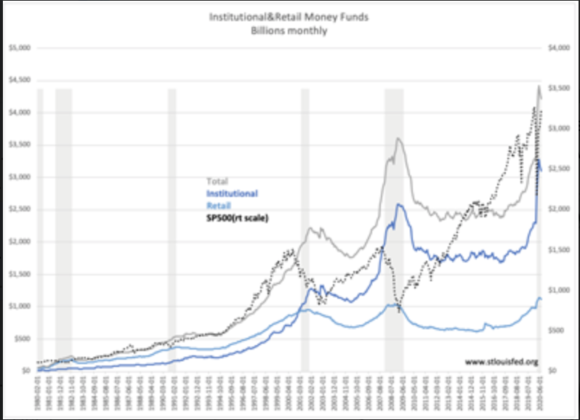

The SP500 vs Money Funds chart is repeated for comparison. Record high Money Funds(short-term fixed income) is representative of high levels of pessimism and severe economic disruption. Current economic conditions reflect a rapid recovery from the COVID-19 shutdown about which the majority of investors do not believe to be true. The record highs for the SP500 has come from this pessimism favoring roughly 3doz companies believe to be favored by the shutdown. The rest of the SP500 remain mostly out of favor. This is why we see record Money Funds and record SP500 with the media spouting “tech, tech, tech” as the only investment option.

Employment is recovering sharply. Once investors realize that the earnings reports from the rest of the SP500 coming out of the COVID lockdown are likely to continue to surprise, Money Fund capital should stream into equities driving all prices higher.