Not a “bubble” but not cheap……

“Davidson” submits:

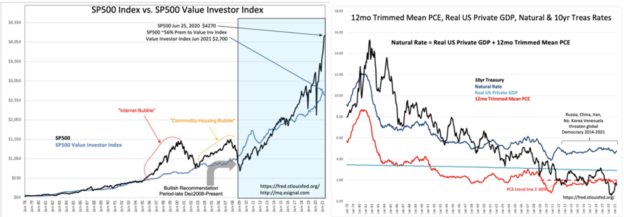

The Dallas Fed reported the 12mo Trimmed Mean PCE currently at 1.89%. This is decidedly higher than Jan 2021’s level of 1.61% or nearly a rise in this inflation indicator of 20% over 6mos. Higher inflation translates long-term into a lower SP500 Value Investor Index and pushes the current SP500 Premium to 58%. This is not a worry at this point in the market cycle as long as the rate spread of the 10yr Treas/T-Bill is widening. A widening rate spread is powerfully economically expansive. Experience suggests worry should begin closer to the 100% level, but not today.