“Davidson” submits:

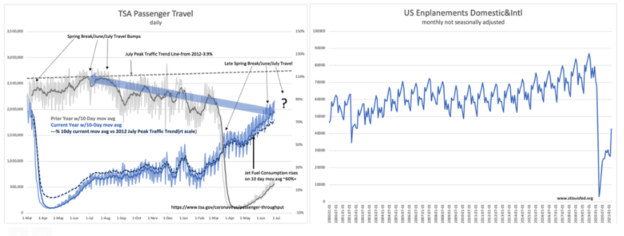

When looking at TSA daily data monthly peaks are deceptive. The 10day mov avg as of this morning is 72% of the July Peak Traffic Trend Line from 2012 and rising quickly. Yesterday’s level was 2,167,380 with pre-weekend and post-weekend traffic recently the highest levels weekly reportedly due to leisure travel with business travel yet to fully catch up. A decided spike in International air travel is accompanying the Domestic surge. The daily chart captures non-seasonally adjusted data while the (BLACK DASHED LINE) representing the July Peak Traffic Trend Line from 2012 comes from seasonally adjusted data.

Peak passenger travel annually in 2019 was ~2.6mil travelers/day during the March Spring Break and ~2.7mil travelers/day in June and July. The daily travel surge was only 3.8% higher in June-July than March. Where June/July surge derives its spikes comes from more days at that level. Annually the low was Feb 2019 with a surge of 35% in July. Airlines vary capacity to deal with monthly trends but it is not as simple as 35% more traffic results in 35% more jet fuel use. One does not see this in the EIA jet fuel data. Airlines may elect to fly less capacity to maintain an attractive schedule to attract future business on lesser filled aircraft than only fly full planes. Today, it appears jet fuel consumption is 11% below the 2012 trend line (EIA carries 2wk lag) while today’s TSA data is 28% below the July Peak Traffic Trend Line. Comparing yesterday’s 2,167,380 with 2019’s 2.7mil daily traffic, we are ~20% below the trend line but rapidly catching up.

Mobility in air travel is a good proxy for economic expansion in my estimation. The one element lacking is the fossil fuel production to support this expansion and the EIA data continues to show a fairly sharp drawdown in US Crude Production in recent weeks towards historic low inventory level 3.5% growth trend line from 2003. Demand has normalized post –COVID. With US Crude Production remaining at 11mil/Day vs pre-COVID 13.1mil/Day peak, prices can only rise unless higher production occurs. There have been no signs to date that increased crude production has been triggered as yet.