“Davidson” submits:

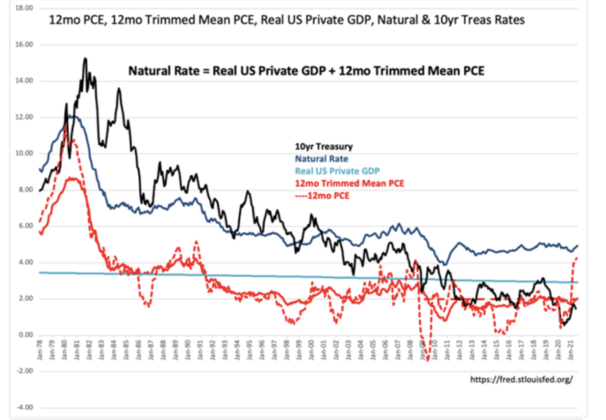

Three charts explain how the Fed acts regarding rates. The Fed uses the 12mo Trimmed Mean PCE-2.03% as its primary inflation measure, but everyone else sees the 12mo PCE-4.94%. The difference between the two is that the Trimmed Mean is designed to smooth temporary spikes and supposedly provide better guidance to the long-term trend and policies. The Trimmed Mean came into existence in 1977 after a long period of Fed inaction regarding inflation in the 1970s. Curbing inflation and maximizing employment are the two primary Congressional directives for the Fed. The problem with these directives is that the Fed only preemptively curbed inflation once since 1953.

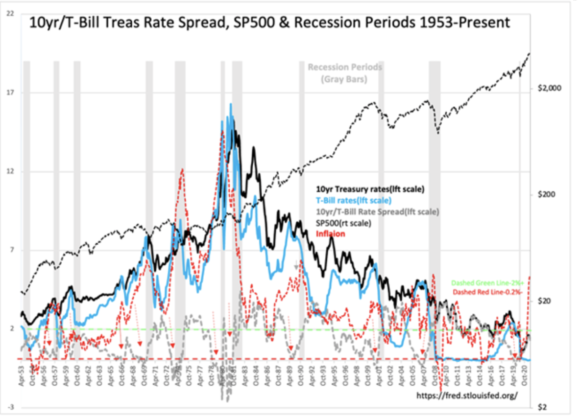

If one examines the detail of rates vs Fed Funds rate adjustments in the daily data from 1953 a pattern emerges with every business cycle with the sole exception of 1979-1981 under the auspices of Paul Volcker. Volcker raised the Federal Funds rate from 11.2% in 1979 to 20% in June of 1981 to quell rampant inflation from equally rampant government spending of the 1965 thru 1970s. He succeeded. Before and since the Fed history shows it to be a follower not a leader in rates.

The first chart shows the difference 12mo PCE and the less volatile 12mo Trimmed Mean PCE the Fed prefers. These are compared with the 10yr Treas rate and the Real Private GDP which are used to calculate the Natural Rate, a valuation indicator for the SP500 called The Value Investor Index(not shown here). The second chart shows the monthly history of the T-Bill/10yr Treas rates and rate spread vs SP500, recession periods and inflation using the historic CPI(Consumer Price Index from 1947). CPI just reported 5.38%. One can see that rates and inflation have a generally strong correlation. When examined in detail, every recession begins with an inverted yield curve with T-Bill rates exceeding 10yr Treas rates. Wall Street has long believed that the Fed raises rates in response to inflation. The facts do not support this perception.

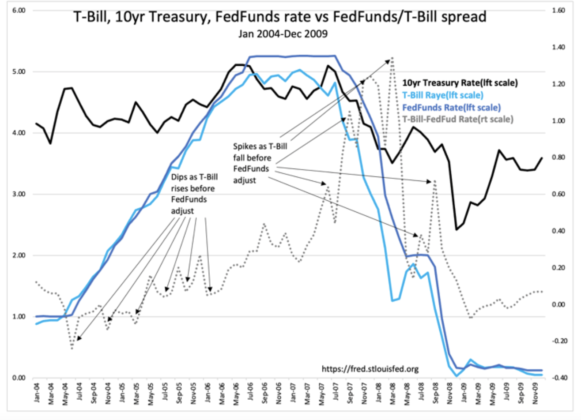

The third chart provides a closer look using the Jan-2004-Dec-2009 period. The T-Bill, 10yr Treas and Fed Funds rates are compared with an added element i.e., the rate spread representing Fed Funds and T-Bills. The reason for examining the Fed Funds/T-Bill rate spread is to detect the timing of Fed actions. If the Fed moves first when rates are rising with inflation then we should see a narrowing of this rate spread as the Fed acts preemptively to raise rates to slow inflation. Similarly, coming out of recession if the Fed is acting to stimulate economic activity, then the Fed should preemptively cut rates forcing T-Bill rates to follow lower. This should be reflected in the rate spread widening during the process. The pattern reveals the opposite with the Fed catching up to both rising rates and falling rates. The Fed follows. It does not lead. One sees this as rates rise throughout the expanding business cycle in the T-Bill/Fed Funds rate spread. The spread dips as T-Bill rates rise just prior to Fed Funds adjusting higher. This is the pattern of following not leading. The Fed works to keep Fed Funds higher than T-Bills at all time. Once rates fall as recessionary activity panic investors, T-Bill rates fall faster than Fed Funds which widens the rate spread till the Fed catches up again following rates lower with a lag in time.

Over decades it has become ‘common knowledge’ that the Fed controls rates. With rate history available to any amateur analyst, the data reveals an entirely opposite picture. One should not expect the Fed to act any different with the current bout of inflation. The history of the 1970s inflation is coupled strongly to govt spending of the period with the Fed following rates till Volcker finally acted. Basically M2(money supply) expanded faster than the economy could replace it with profits(another term to use for profits is equity, as in shareholder equity from the corporate world).

This explanation of inflation lays out why Bitcoin cannot become a currency, unless of course the US government decides to issue its own and command the banks to operate on that basis. If not, Bitcoin will never be a substitute for currency. A transfer token, yes, but never a currency. Inflation occurs when the expansion of currency occurs without adding equivalent economic value to the economy. If the value of currency matches the value of the existing level of economic activity over time, the value of currency remains stable. In real life, economic value fluctuates with the business cycle as does the level of currency necessary to operate it. Economic growth requires currency growth to match. The amount of currency must vary and therefore it must be created or destroyed by free market competitive economic processes. The desire to have an unchanging amount as a value exchange medium misunderstands how currency operates.

The way the currency process works is that when a business seeks to expand by borrowing, they seek lending from banks. Banks seeking to make a profit perform due diligence and through the fractional lending system make a loan. That loan priced in currency is an expansion of currency to the system. If the business succeeds, the loan is repaid with profits and on the books of the corporation, debt converts to shareholder equity. The process of making a profit requires that the businesses must have provided greater value to consumers than prior or competing offerings. This means that consumers advanced their standard of living with something of better value using the company’s offerings i.e., by lowering their cost of living means that innovation is inherently deflationary. Business success depends on being more cost efficient than others using available resources. Net/net successful businesses are inherently deflationary offering to society faster, better cheaper means of advancing their standard of living. Since in a competitive marketplace, it is consumers making the spending decisions, then consumers behavior is inherently deflationary seeking the best value for income earned. During the business cycle more lending results in more currency and profitable companies turn temporary currency backed by the promise of success into currency backed by equity. Those companies which fail, default on their debt and banks must write off the value which erases the currency earlier had created. The value of currency is an intimate part of economic activity and its processes. Bitcoin only becomes currency if banks create it when they lend to expand societal innovation. It has to be part of the process, not something created in a closet. It must be something created at the beginning of the economic value creation process that survives or is cancelled on the success of business adding equity. Otherwise, it is a token with value only in someone’s imagination.

Inflation occurs when governments issue debt and do not add economic value to society. Governments could cancel the inflation they create by paying off the existing indebtedness, but they rarely seek to do this. Existing economic equity is diluted with every issuance government debt and inflation is the result, This occurred in the 1970s and is occurring today. How severe and how long the current government spending impact is dependent on political decisions and impossible to predict. It is not transitory when M2 having expanded 30% and threatening to expand more is matched with Real Private GDP ~3% annually. We are between the proverbial ‘rock and a hard place’. There is no cure other than to let it work its way through the current and perhaps future cycles. (unless of course political decisions are made to paydown government debt)

The key points made:

- Inflation occurs when currency growth exceeds economic growth, in particular the growth that adds to a permanent improvement in society’s standard of living

- It is government spending that is inflationary while consumer spending is inherently deflationary

- Currency creation is an intimate part of the value creation process and has the same growth rate

- Longer term rates are set by markets which respond to self-governance policies. Policies which expand currency above the natural growth of society cause inflation and raise rates

- Central Bankers follow rates. They do not have the ability to control rates.

- The concept of ‘hard-currency’ misunderstands to role of currency in smooth functioning societies. Bitcoin is a misperception.