This is a good warning for all. The fundamental business DE is in has not changed materially nor has their end markets. For its valuation to be this extreme should have investors in it concerned.

“Davidson” submits:

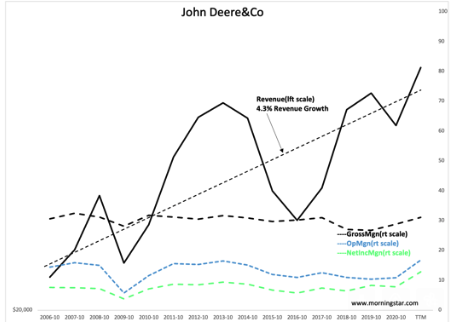

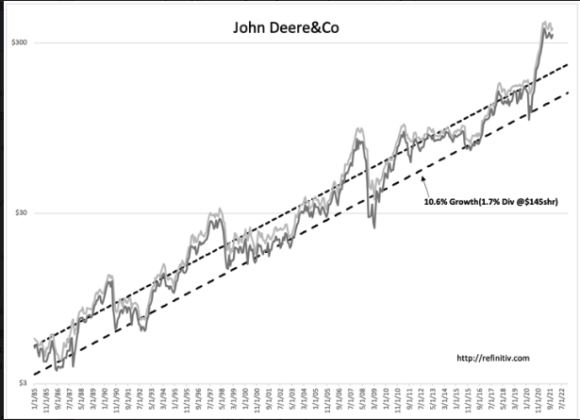

People still piling into DE as if its the next new trend to be a part of. It sounds like people building self-esteem being associated with ‘winners’ DE has a long history of cyclic revenue averaging to ~4% Revenue growth. Investor psychology ebbs and flows with the headlines. Since 2020, DE has moved to 2.62x Revenue, a 10yr high from avg prior levels of ~1.25x Revenue. Comparing DE’s financial vs Price Metric histories is how one can tell that it is more increased investor enthusiasm than it is a ramp higher to sudden rise in profitability.

Yes, there is a pop in NetInc Margin, but coming out of COVID and with every company understaffed which means higher profitability with lower labor costs, this does not mean DE has suddenly morphed into a higher growth company vs its past. DE’s revenue certainly does not support this and the sharp rise in share prices represents 100% premium to prior pricing.

Yet, multiple recommendations recently declare DE the best new idea.