“Davidson” submits:

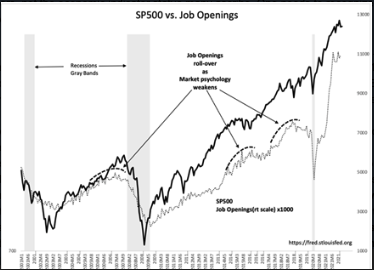

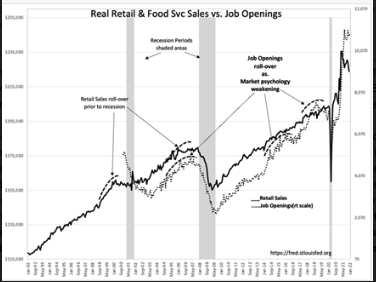

Job Openings series is a market psychology indicator. While Retail Sales, Employment, Vehicle Sales and etc are hard counts(estimates in fact to be revised closer to actual counts as data comes in), market prices and Job Openings are market perceptions of future outcomes. This makes prices and Job Openings market psychology indicators, not the economic indicator status many ascribe. One needs to recognize each indicator’s context and value and not conflate more of a basis than it actually represents.

In Mar 2007 Job Openings peaked markets peaked Oct 2007. A recession followed. Jan 2019 was another peak in Job Openings .A recession did not follow till government forced economic closure due to COVID, an unrelated event, 2018-2019 were years rife with many forecasts for recession and market correction, yet Retail Sales continued to rise on trend. The Employment, Retail Sales, Chemical Activity Barometer, vehicle sales, Intermodal railcar loadings and etc, which are hard counts of economic activity, continued in uptrends indicating economic expansion during periods of weakening Job Openings.

The fact that Job Openings have spiked to record highs in recent months indicates demand for employees by the employers who report to the Bureau of Labor. This is a good measure of business owner psychology and expectations. The current period is a bit tricky with the Retail Sales peak during COVID remaining well above trend and beginning to normalize. This is where the T-Bill/10yr Treasury rate spread becomes useful. Rising rates indicate capital is shifting to equities. A widening rate spread indicates relative conditions for improved lending by financial institutions. Rising oil prices indicate expectations for economic expansion and greater oil demand.

Note: rising oil prices do not reflect changes in demand for oil as much as investor perception of demand for oil. The record reveals oil use is relatively inelastic with regards to price. We need to run our economic systems, public transport, municipal and government services, transport goods during recession at nearly the same level during economic expansion. Buses, planes, trains and ships still have to operate even if only partially loaded. Better operate at partial capacity than shut down and lose one’s customer base. Homes, hospitals, places of business still need to be occupied and heated even if fewer people are using the space. I.E., fuel use tends to be inelastic!