Unprecedented stimulus leads to outcomes we’ve not seen before.

Davidson” submits:

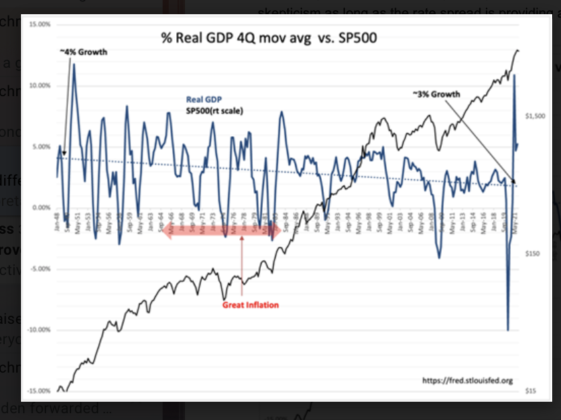

The traditional interpretation is that declines in Real GDP always reflects a decline in equity prices i.e. a major market correction. This time is not like the past.

The important economic indicators, goods transport, retail sales, employment, vehicle sales and personal/business travel remain well under peak levels of economic activity. The other key indicator is the T-Bill/1-yr Treasury rate spread which has recently widened to new post-COVID highs and continues to hold in the face of Russia’s insistence it is being invited into Ukraine. With the controversy against vaccine mandates and the trucker response in Canada, this has all the elements of a world going out of control. It remains that we are exiting the COVID era with economic activity below peak levels despite the Real GDP having ballooned to levels not seen since WWII. Some have forecast a coming collapse as GDP falls back towards the trend from 1947, the Dotted Blue Line.

This time GDP correction will not come from a period of excessive consumer/business exuberance. GDP correction at this point is economic normalization. While some indicate we should fear a negative GDP print in months ahead, the rate spread reflects economic expansion and is in correlation with rising employment, rising consumer activity and most importantly increasing liquidity. While the SP500 has been correlated with prior GDP slump slumps, it was always due to economic weakness. Economic expansion is on track to expand the next 3yrs-5yrs with many solid forecasts by core US industries and underlying economic trends.

GDP will certainly print negative growth YoY from the excessive levels just experienced. This should be read as ‘non-economic’. There was considerable ‘US production’ if one looks at the revenue growth of the COVID-shutdown favored issues. In my estimation most of this was not overly productive from a profit perspective and therefore net/net not true economic growth. These revenue streams will correct as Peloton is correcting today to be replaced as core industrial companies continue to gain their footing.

There continues to be significant opportunity in my opinion outside the group of high-performing issues of the past 2yrs. Any dire forecasts should be met with high skepticism as long as the rate spread is providing a strongly positive economic signal.