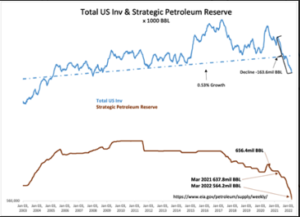

The bottom line is the same as we’ve been saying here for over a year now, the risk of much higher prices materially outweighs the odds of significantly lower ones. What is particularly alarming is the massive drain on the SPR. While, fundamentally, withdrawals from it make no significant difference, there is a massive mental “safety net” having 500-600M barrels of oil in reserve. As that gets depleted (it is down significantly over the past three years and is at near 20-yr lows) one can easily see the market getting spooked thinking we have few options to relieve price spikes and more importantly, supply the market. This could lead to another wave of price spikes as people begin to panic buy

It also means we will eventually be adding supply to the SPR at absurdly high price levels…

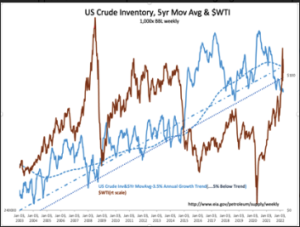

Supply is not coming online anytime soon and it isn’t due to oil companies’ “profiteering”. In order to add capacity, we need more pipes, lots of them. Those pipes come from steel made overseas and supply chain issues have all but assured nothing significant is happening for several months.

“Davison” submits:

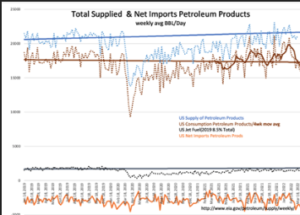

- US Crude Prod rises 0.1mil to 11.8mil BBL/Day, Total US Inventories fall 1.3mil BBL(a rise of 2.4mil working inv & decline of 3.8mil SPR), US Crude Imports fell ~0.7mil BBL/Day

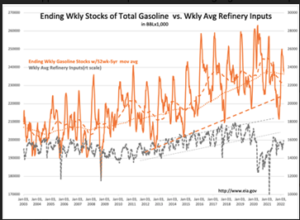

- Refining Inputs unchanged, Gasoline Inv decline 2.1mil BBL, US Exports Refined Prods rise towards peak levels resulting in the appearance of lowered Domestic consumption levels

US Inventories of crude and refined products continue to decline reaching new lows for crude in nearly 20yrs. US production remains well below peak levels with needs met with declines in inventories and varying levels of imports reported ~0.7mil BBL/Day lower in this week. The fudge factor is 1.3mil BBL/Day of crude oil in today’s report is large.

It appears that refined products are holding higher at the expense of Domestic supply.