This is alarming. The administration is finally figuring out that the thousand of DUCS (drilled, uncompleted wells) that were out there were there for a reason, they are not high return wells. DUCS has gone from 9,000 in October 2020 to under 4,500 now and oil supply is not catching up to demand. There seems to be this delusional thought out there that oil companies are just sitting on massive and hugely profitable wells just waiting for high prices. Literally, nothing could be further from the truth. DUCS are there primarily because they are NOT high producing wells and unless we see high oil prices, these wells by in large will never be drilled simply because at <$70 oil, they just are not profitable.

If you looking for proof, just see the results. Production has not nearly kept up with the decline in DUCS.

It’s alarming how out of touch the administration is with this. When rolling blackouts start hitting big cities across the northeast and west coast this summer, people will begin to get it then. Why the northeast and west coast? The midwest has taken care of its gas supply by not stopping pipeline projects. They will be just fine.

Buckle up kids…..

“Davidson” submits:

Oil plain and simple is in a significant supply deficit vs consumption. Prices rising reflect the realities of missteps by the current push for EVs and alternative energy sources that are not yet technologically feasible.

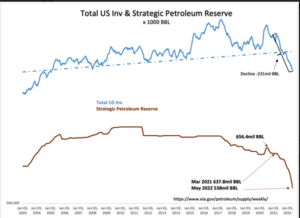

- US Crude Production rises 0.1mil BBL/Day to 11.9mil, Total US Crude Inv* fall 8.4mil BBL(3.4mil decline in working inv & 5mil decline in SPR), Crude Imports declined 0.35mil BBL/Day(2.45mil BBL/Week *Fudge factor is a negative 0.214mil BBL/Day(-1.5mil BBL/Week)

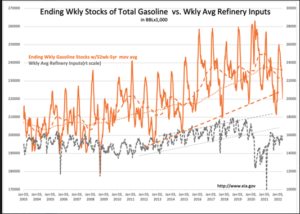

- Refining Input rose slightly 0.25mil BBL/Day, US Gasoline Inv declined 4.8mil BBL, US Refined Prod Exports holding higher

US Crude Inventories continue to decline as do Refined Product Inv. Refined Products Production is gradually rising with net demand drawing all inventories lower which continues to reduce working capital and forces capital efficiencies into all aspects of the energy complex. Refining capacity has risen in the face of some shutdowns due to regulatory actions resulting in closure vs upgrading equipment.

EIA DUCS report this week indicate well completions nearly equal to new wells drilled as viable formerly drilled but uncompleted well inventory is reportedly rapidly diminishing.