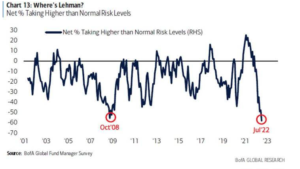

I remember back in 2009 talking about cash balances being so high. This is definitely a positive for the market. I keep hearing there has not been any investor capitulation in the market. From this measure, it sure does look like there has been and maybe more.

“Davidson” submits:

Every market has it quirks making it unique from the past. The sharp rise in T-Bill rates as $WTI plunges makes no sense unless one views algorithmic hedging using oil which reflects current pessimism is enough to drive T-Bill rates sharply higher. This has no precedent as does the current level of algorithmic trading. High cash in portfolios with low debt delinquency leads to inferring rising T-Bill rates as panic hedging using every technique available. Committing reserve capital to hedging drives T-Bill rates higher even though it is difficult to be precise about the capital flows. That T-Bills have seen this impact suggest heavier hedging that ever deployed in past periods and extends well past oil and other commodities.

This recent report, a survey of portfolio manager market psychology, indicates the current environment is worse than 2008 if one can believe its accuracy. 2008 was a significant equity buying opportunity. Today represents an similar opportunity in my experience. When traditional equity mangers favor cash over equities to the extent similar to high levels of pessimism in the past, then being a contrarian individual investor has always, over time, been beneficial to returns. In my experience, insider buying at prices that severely discount the long-term financial performance of skilled management teams is the best methodology. The link provides the story details.

BofA Survey Shows Full Investor Capitulation Amid Pessimism

July 19, 2022 at 4:42 AM EDTUpdated onJuly 19, 2022 at 10:10 AM EDT https://www.bloomberg.com/news/articles/2022-07-19/bofa-survey-shows-full-investor-capitulation-amid-dire-pessimism