“Davidson” submits:

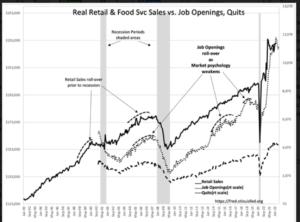

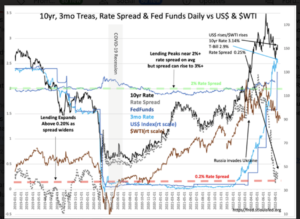

Close observers recognize that markets never repeat. A prime example of a significant non-repeat is in today’s data. Four charts spell this out. The WSJ article notes that hedgers have built short positions similar to June 2020. One would think that high levels of market pessimism, as displayed in Retail Sales, Trucking Tonnage Index&Michigan Consumer Sentiment, would produce a similar response from T-Bills as the historic safe haven. But, T-Bill rates rise to a post-COVID high on investor fears, 2.903%. Couple this condition with a surprise rise to new highs in the Trucking Tonnage Index, (June was revised higher to new high), the steadiness in Real Retail Sales and Quits and their history of indicating weakness prior to 2001 and 2007 recessions, leaves us with a sharp dichotomy never before witnessed.

A couple of additional oft-repeated observations from past periods with similar market pessimism.

- As in this data, hedging occurs after the worst of the decline has caught investors off-guard. Hedging at this magnitude is actually an indicator of market lows.

- The T-Bill rise today is atypical in market history with pessimism and with increased fear in recent days has risen to a new high with additional fear.

Algorithms are mathematical trading tools designed to input trades based on prior price trends but traders always tweak them for what may be deemed unusual conditions. On observing that market fears are not supported by economic indicators one is forced to infer what is going on by one group of investors vs fundamentals. The explanation is that hedgers are over-confident(and or fearful). Reserve capital normally stored in T-Bills has been committed to hedges and short positions expecting high returns which they believe must be ahead on the next Fed rate rise. Their market perception is so skewed because they see that so many other investors agree with them that they have shifted T-Bill funds into what can be called ‘speculative hedging’. This is the identical behavior typical of market tops during periods of overt optimism which also drives T-Bill rates into inversion vs 10yr Treasury rates, the classic Inverted Yield Curve that leads to recession. The hedge community has likely skewed the Yield Curve signal in this selling of T-Bills. Reports indicate they have shorted oil, other commodities and, as above, equities. It is likely they are also buying 10yr Treasuries(driving 10yr rates more to inversion). Prior sharp economic declines historically favors such short positions. The T-Bill rate rise is a unique feature in the current environment. The economic data does not support doing any of this.

What happens the next few months is likely to be entirely opposite what hedgers anticipate.