“Davidson” submits:

The discussion focused on inflation is at best muddled as to sources, cures and the proper indicators. Add to this mix, politically directed government action with a heavy overlay of political finger-pointing and strong biases in every corner serving personal agendas. Making enough sense of this arena is fraught with controversy. Nonetheless, it requires careful navigation to generate returns because the perceived safety of fixed income is not an option as rising rates guarantee losses. What used to be a single decision by many to simply buy gold has not proved useful as gold prices have declined losing its position as a favorite currency medium to cryptocurrencies executed on cell phones.

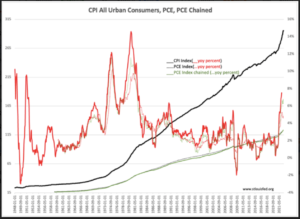

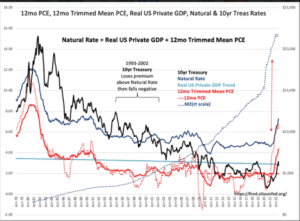

Inflation in my experience comes from mistakes in government policy which expands currency without a subsequent expansion in economic growth as measured by Real Private GDP. Using Real Private GDP subtracts the short-term impact of government spending which skews Real GDP providing false guidance to those who believe governments can spend their way out of recessions. Not so when the longer-term Real Private GDP is used. Many believe simplistically that M2 expansion/contraction is the basis for inflation/deflation. Not so!. M2 is a gross measure of borrowing and includes consumers, businesses and government. The first two categories are much larger than government. Their spending is directed to building net worth which expands Real Private GDP and as they seek greater value than the effort they expend, their actions prove deflationary. This is why expansions of M2 due to these categories are not inflationary and lead to gains in economic productivity. Government spending, however, has no measure for value creation and is often directed towards political ends which prove outright inflationary. The simple explanation of inflation is a monetary is phenomenon misses half of Milton Friedman’s thesis. He famously said: “Inflation is always and everywhere a monetary phenomenon, in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.” The emboldened section of his statement has been mostly ignored. They awarded him a Nobel Prize and promptly ignored this insight.

Inflation occurs when net currency expansion does not expand societal output. In other words, the cash issued was not productive but it was also not cancelled and therefore diluted the existing value of productivity.

With the fixed income and gold options not effective in today’s climate, one must focus on equities. This requires a top-down analysis of economic conditions which can be translated into individual equity suggestions.

- The top-down analysis of current conditions shows consumer and business delinquency rates falling. The financial system remains quite favorable for economic growth.

- The COVID-favored issues are in sharp correction with little attention paid to post-COVID issues crucial to economic growth with demand permitting them able to pass on inflation.

Key indicators support continued economic expansion. The companies which supply the basics of economic expansion are seeing unsatisfied demand during the COVID lockdown. These companies are able to pass on inflationary costs to consumers and end users. Traditional energy companies, companies which manufacture vehicles, aircraft and related equipment, companies that support goods transport such as truckers, packaging and etc., are just a few of the opportunities which remain discounted to historical financial performance.

The companies adding economic value will report growth exceeding inflation measures. These will become the new favorites as we move forward in my opinion. Investors will climb on board once they identify the ‘new winners’.