The risk of substantially higher oil prices continues to outweigh lower ones

“Davidson” submits:

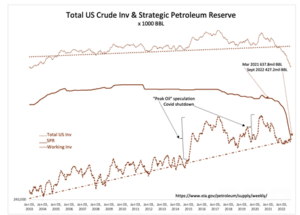

- US Total Crude Inv declines 5.6mil( increase of 1.2mil working inv and decline 6.6mil SPR) US Crude Prod unchanged at 12.1mil BBL/Day, US Crude Imports rose 1.2mil BBL/Day(8.4mil BBL/Week), Fudge factor >0.5mil BBL/Week

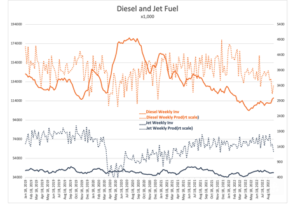

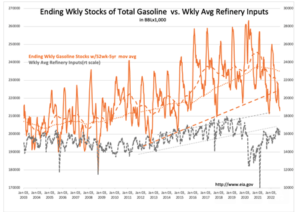

- US Refined Prod Inv held mostly steady even while Refined Prod Exports rose close to all-time highs

With global fossil fuel production and consumption figures unavailable as frequently as in the US and generally unreliable, US Exports of Refined Products rising is the only signal that global demand may be rising after holding relatively steady last 6mos. More data on this is required to be sure. This is not unexpected as Eurozone turns towards fossil fuels with issues in alternative energy sources proving inadequate. Certainly, LNG has been in high demand but some impact on oil is not unexpected as LNG prices soared to extreme levels.

Note that US working inventory at ~430.7mil BBL exceeds SPR by ~3.5mil BBL at 427.2mil BBL. This is a first time in memory the SPR declined below commercial inventories.