I know some people who have done very well in international markets. However, by and large, they are people “from” those countered now in the US. The typical US investor (including myself) has limited knowledge of the peculiarities of an individual country’s laws, customs and markets and thus are essentially investing with “partial knowledge” .

It’s not something I like to do or are comfortable with. There is MORE than enough opportunity in the US without having to essentially roll the dice on a foreign market.

“Davidson” submits:

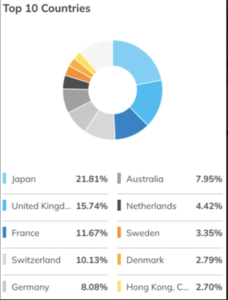

The data for EFA(Advanced Intl Markets) and EEM(Emerging Markets) has been available since 2006. The 1st chart compares the SP500 vs EFA and EEM from Jan 2009, the current investment cycle depending on whose definition one relies. The 2nd chart compares the Hang Seng(HIS) vs. SP500 which is the best way to isolate the impact of Chinese issues in the EMM. Many continue to recommend global diversification with Chinese markets often highlighted as offering higher growth opportunities. The data presents a different perspective. The 10 top countries in EFA and EEM are listed at the bottom.

The data shows:

- SP500 has outperformed by a wide margin at 10% annual growth

- EFA has 2.7% annual growth(this includes the Eurozone, Australia, Japan, some Hong Kong)

- EEM has 0.9%(the larger components are ~31% China+Hong Kong, ~15% India and ~15% Taiwan)

- HIS has 0.0% growth since Sept 2009 and recently has moved lower

Chinese issues, which comprise nearly 31% of EEM, are often promoted in the media as growth opportunities. HSI long-term performance in recent months is worse. Wall Street if anything is a sales machine. The only viable choice for investors in my opinion is to remain solely in SP500 issues. Such a difference in performance begs the question “Why?”.

The differences in performance in my opinion can be attributed to the self-governance principles in the US that are not present elsewhere. It is a long story, a short version is only possible in a note. It has its roots in human evolution with evidence of human communities 4million+ years ago. It is revealed when the Dutch reclaimed land from the North Sea ~400BC, https://www.thoughtco.com/polders-and-dikes-of-the-netherlands-1435535 Land reclamation was innovative and entrepreneurial and proceeded for the next 2,000 years. They were farmers who reclaimed land creating an independent market place of exchange and in the process developed rules for fair trade independent of the demands of a string of rulers who believed this area worthless. As Dutch traders developed sea routes and came into contact with competing traders, Dutch jurist Hugo wrote Mare Librium(Law of the Sea), 1609 to settle International disputes. https://en.wikipedia.org/wiki/Mare_Liberum This was the source of The Flushing Remonstrance, 1657 authored by the traders in the community that was to become New York City in their push-back to Peter Stuyvesant’s autocratic governance. In turn, this document evolved into the US Bill of Rights represented by Amendments 1-10 of the US Constitution.

The US Constitution is the only self-governance document globally preserving individual rights against government intrusion vs free speech and property protections.

- Freedom of speech (freedom of self-expression)

- Right to self-defense

- Protections against unlawful seizure of property

- Freedom of association

- Other rights and government power is limited

Freedom of expression and freedom to exercise control over one’s own property including innovations and how these are developed into products and services has a level of protections in the US not found elsewhere. It is these protections which lead individuals to create value through innovation that are not present to the same level outside the US that make the US best for investors. It is the secret sauce missing from modern investment analysis with only considering quarter-to-quarter mathematical comparisons of one country vs another. Those recommending investment in countries problematic to individual property rights do not consider the cultural context. I believe they should.

SP500 is the only choice for investors in my opinion.

At the individual company level, similar respect for individual creativity is the basis for long-term out-sized business performance commonly called ‘Lean Management’.