“Davidson” submits:

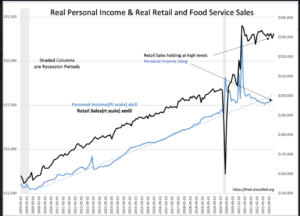

Real Retail Sales post a major positive surprise leaving many confused. Larger surprises were in vehicle and restaurant sales as economic activity continues to exit the COVID era. The analyst miss comes from taking a single month’s dip as if it is the next 12mos trend. The overall context remains economic expansion post-COVID with rising Real Personal Income supporting a shift in retail sales from goods and services that supported needs during lockdown over to those areas reflecting reopening and normalization post-COVID. At some point, investors should expect the high level of retail activity to normalize to the trend pre-COVID. Support for the expansion continues from rising Real Personal Income that remains below the trend pre-COVID. Real Personal Income remains ~3% below this trend line.

Unexpected and significant retail sales gains occurred in vehicle sales and restaurants. The restaurant sector is one area of strongest employment growth in recent reports. Investors did sell the markets lower on this report with the belief rates will rise in response to inflation caused by consumer demand. What is being missed, in my opinion, is that consumer spending is deflationary as consumers are the most frugal spenders in the economy. Consumers spend to advance standards of living which translates into replacing older, less valued goods with faster, better and cheaper goods relative to standards of living. Consumer spending is flat-out deflationary. Consumers are not geared to spend themselves into a poorer less advantaged lifestyle.

This is another report supporting economic expansion. Markets will eventually recognize that this level of activity has not been quashed even by current rates or likely even by rates 2x as high. Past economies have expanded at much higher rates. I expect inflation to persist unless government does an about face on spending. I expect rates to rise towards 7%-8% levels. I expect economic activity to continue on the current trajectory for at least a couple of years.

The better equity positions are companies crucial to supplying the basics of growth and are able to profitably pass through inflation costs.