“Davidson” submits:

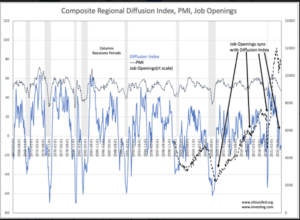

It is important to be able to tell what indicators mean and not to conflate those of lesser value in making decisions with those that carry high value. Job Openings tend to track PMI and Fed Diffusion Indices. While the PMI and Fed Diffusion indicators have called for recessions 3x more often than actual recessions making them clearly measures of market psychology, Job Openings has both a labor demand and market psychology components. When the headlines warn of recessions, demand for labor reflects greater caution in businesses hiring and they reduce advertising for openings. Yet, if the economy is trending higher, Job Openings do not rollover to recessionary levels unless there is a recession forcing actual retrenching.

The PMI and Fed Diffusion Indices are so reflective of market sentiment that they become very useful in identifying market buying opportunities when employment, a high value indicator, signals continued growth. The mismatch in PMI, Fed Diffusion Indices and Job Openings(lesser value) vs the Household Survey(high value) is such an opportunity today.