“Davidson” submits:

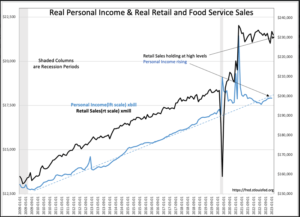

Real Personal Income and Retail Sales have been holding at recent highs despite voluminous calls for recession and claims that consumers have pulled back spending. These recession calls are more prevalent on dips in the monthly reports which when viewed for a multi-month trend appear steady.

That Real Retail Sales have held up is likely a result of lockdown home confinement spurring a concentrated spending pattern for home office and entertainment outfitting that is now directed to the broader categories that suffered during the lockdown period. We should be surprised that post-lockdown spending has held up as well as it has and should expect some normalization to bring future reports lower. Thus far, slowing is not in the data.

Real Personal Income has nearly risen back to the pre-lockdown trend. However, employment remains ~4mil off the pre-lockdown COVID trend line(not shown).

Rising rates and banker missteps reinforce the recession forecasts but the data does not indicate a recession near term.