“Davidson” submits:

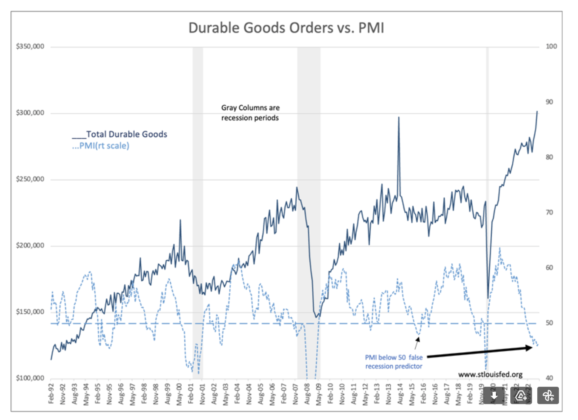

Manufacture’s New Orders for Durable Goods and the PMI(Purchasing Managers Index) for manufacturers were reported last week. Durable Goods Orders vs. PMI compares these two series monthly from Feb 1982. The rule-of-thumb which has been repeated many times is that when the PMI falls below 50 it forecasts recessions. This is stated so strongly that many believe in the PMI as one of the more reliable indicators. The data indicates this belief is seriously misplaced and never more so than today.

The history of the PMI falling below 50 shows it is sometimes coincidental but many times calling for recessions which never occurred. The PMI more closely correlates to slower periods in Durable Goods Orders which itself is not perfect. The PMI has been forecasting recession since late 2023 but Durable Goods Orders has been soaring and by all appearances is in the widest divergence of these two series, Large Black Arrow.

Durable Goods Orders is spiking because the economy is still exiting COVID-lockdowns and multiple supply chain disruptions. In the US, demand for air travel continues as does demand for light weight vehicles both of which have boosted Durable Goods Orders. The ultimate drivers remain at decent levels, Real Retail Sales, employment and Real Personal Income. Until these show signs of rolling over, US Real GDP can be expected to rise with a rise in associated equity prices.

The PMI is a sentiment indicator that is one of many which have been conflated as an economic measure. Durable Goods Orders is an economic measure as are employment, retail sales and personal income. That the PMI is conflated as a primary economic indicator is a misperception. It has forecasted 3+x more than actual recessions. This period appears to be a more severe mismatch. It is better to use the PMI lows as a measure to buy equities at lower prices that represents an opportunistic mismatch between economics and market sentiment.

Use the current period of equity weakness as an opportunity to add capital to well-managed companies selling well-below their historic pricing. The goal is the buy these business at such a discount that one out-paces the overall market despite indices being manipulated by highly favored issues priced at extraordinarily high prices.