“Davidson” submits:

In recent months, the TSA Air Passenger Travel climbed to 95% of the long-term trend from 2012. After recovery to the 90% level vs the 2012 trend, air traffic stalled for more than 12mos with China’s continued shutdowns and global changes to supply-chains. China appears in a recession of its own making from an economy overly-dependent on real estate development and a desire to for global dominance of vital materials and exports forcing trading partners to seek alternative solutions.

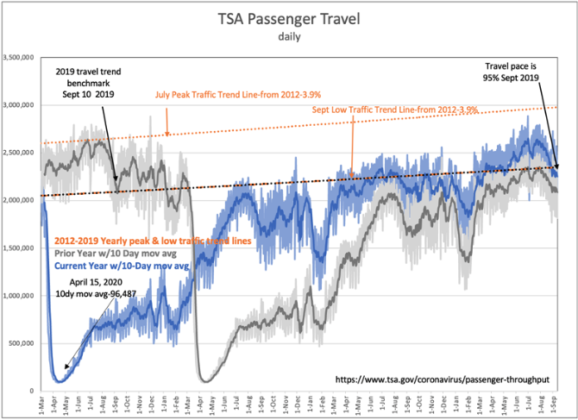

The mix of travelers has favored leisure travel and reported to be the primary growth factor with the more profitable business traveler lagging. Even so, activity has risen closer to the long-term trend indicating that global economic expansion is present. This does not change the recommendation that investors remain focused on mostly US Domestic issues. US$(US Dollar) strength continues with favorable global capital inflows. In the TSA Passenger Travel chart the annual low travel period is early Sept with July being the annual peak as shown. 2019 is used as the benchmark year to extend the 2012 trend line. The COVID lockdowns added considerable volatility to data that already carried high annual seasonal volatility. Just the same, a recovery in travel is apparent and a sign of positive times.

The pace of new aircraft orders continues with weekly announcements. When China formally takes the Boeing 737 Max planes ordered and manufactured prior to COVID, expected shortly, investors are likely to respond positively.