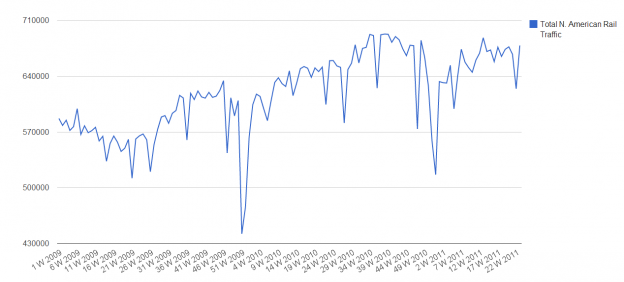

Total N. American rail traffic rebounded from the expected Memorial Day week slump to rise to 678K cars, the highest level in ten weeks.

What is interesting about the numbers is that both stone products (as in crushed) and metals, both large indicators of manufacturing and construction hit the highest levels in a year (metals, the second highest level). For those wondering about a “Holiday Rebound” off the previous weeks drop in those numbers, yes it is a factor but the degree of bounce vs previous levels is in excess of the last two years. Also, lumber rebounded to within 1% of its highest level in over a year and also the second highest level in over two years. These are all positive for the manufacturing/construction sector. After the slow rise in rail traffic for near two quarters now (note how GDP was unimpressive also) a pickup here would mean we can expect GDP to follow suit for Q3. Now, as usual one week means nothing, we need to see this follow through but the sectors that came back, and the degree to which they did is a positive sign no matter how one cuts the numbers.

For the carriers, $CSX, $BNI, $NSC & $UNP all saw significant gains while $KSU was essentially flat. Both the Canadian and Mexican rails were also flat week over week.