“Davidson” submits:

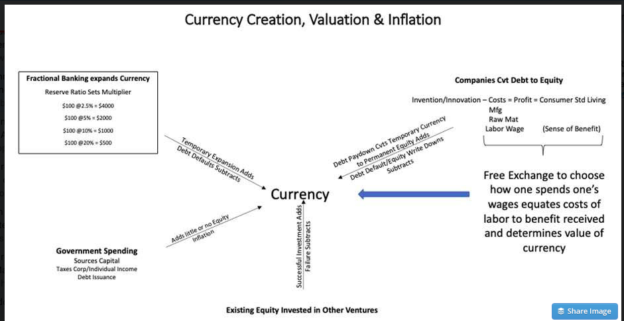

This illustration helps to explain how currency is created, valued and inflated. Currency carries the ‘experiential cultural values’ of the society in which it is created and cannot be isolated from the process of a particular society’s invention/innovation additions to the standards of living of its citizens. The US$(US Dollar) has become accepted as the most trusted and most used in global transactions for holding its value. It is such a complex process that it has always been exceedingly difficult to extract the essential details. This illustration attempts to simplify the important elements of currency creation, its valuation and how it historically has succumbed to inflation.

First, currency is only valued thru daily transactions in a Free Market of individuals working as part of the valuation chain in which we spend earnings on product innovation to improve individual standards of living. It is through billions (perhaps trillions-depends on who is counting) of individual transactions daily in which currency is used to transfer the value earned using one’s productivity to create products and services for others while at our own workplace (our productive output) to others as we purchase their output to sustain or advance our standard of living improvements. The exchange of earnings for products is the valuation judgement we make based on our sense-of-worth vs benefit received from other’s efforts and additions we desire to our standard of living. Currency’s value changes every day with daily reassessments of the value of our own efforts vs. the value produced by others. Newer products derived from invention and innovation enter the Free Market and displace older less valuable offerings through our freedom to choose which offerings are best for us. With enough choice in products, enough information about product quality and a Free Marketplace from which to choose, society constantly lowers the costs to achieve higher standards of living. Using society’s resources ever more efficiently should be deflationary. This is not what we see.

Second, how the financial system and government interact has long been a source of inflation which has been noted since Aristophanes in his play “The Frogs”, which dates from around the end of the 5th century BC. The term ‘Bad money chases out good’ is as apt then as now. Currency has its birth in business expansion and the need to transfer the value of labor and conversion of raw materials to products at one point in time to another time when customers are ready to buy products. Currency holds no value itself, but should be thought of as a marker of value established by society’s experience at a point in time. If holders of currency hold it for a short period, the value changes little. Holding currency for a long period often reflects a change in value. Typically holders see less value due to inflation. This is not a result of the financial system or supply/demand.

The financial system has developed fractional lending banking. This means that by keeping a certain reserve requirement, i.e. equity level or Book Value, and applying underwriting standards developed through experience, banks can lend more than they have on deposit and make relatively consistent profits. In Western societies, a reserve ratio of 10% with prudent lending standards has been about right over time. At this level $100 of deposits becomes $1,000 of lending. It is periods when the reserve ratio falls to much lower levels that lending firm failures rise sharply during periods of distress. The Subprime Crisis was populated by skewed underwriting standards and reserve ratios in the 5% range, Lehman and Bear Sterns were reported to have only 2.5% reserves which led to their demise.

Prudent lending multiplies the currency available for business during economic expansion. This is temporary currency. Successful borrowers and businesses pay down borrowings and this in turn swaps currency created by debt for currency supported by equity. Over multiple lending cycles, the level of currency more or less equals the level of equity or GDP a society has created across those economic cycles. As societies become larger, the amount of currency must expand with the value creation. When borrowers fail to repay debt and default, lenders must write off the lending value and the value of temporary currency declines. For the US economy, the Real Private GDP growth rate is ~3% and represents the pace our society creates value. A successful society will never be able to use a hard asset such as gold to back its currency. Growing economies must expand their currencies to match their value creation and therefore must use proxy currencies. Fixed-value hard-asset backed currencies at some point stall economic growth. In addition, currency is created to operate businesses via the lending system and pay for raw materials which is used to convert innovation and invention into offerings for society and then in the direct exchange of the value a company’s labor force exchanges for offerings for their own standard of living. The value of currency is defined by this entire experience. Currency is a token of value in this process. Cryptocurrencies created in a closet with a tower of electronics cannot be a substitute just as gold cannot which only represents the labor of a very small section of economic activity. The creation, use and definition of currency in any society is generated naturally by the financial system and production of that society as it supports and advances its standard of living. Currency is created temporarily through fractional lending, then converted to permanent equity through debt pay down. Temporary currency declines with defaulted debt and permanent equity declines by writing off failed equity investments.

Currency Growth = GDP (Equity) Growth

Currency is experiential. There are no substitutes possible!

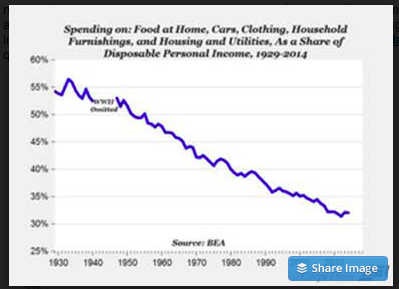

Inflation: Where does it come from? The most underrated economist is Julian Simon who wrote the “The Ultimate Resource 2”, 1981. He highlighted society’s natural direction in using natural resources as deflationary. The ‘ultimate resource’ is human invention and innovation. He used to make bets with colleagues that any natural resource would be cheaper in 10yrs net of inflation through human innovation. He nearly always won these bets. Mark Perry wrote about the results of innovation in his “The ‘good old days’ are now: Home appliances today are cheaper and more energy efficient than ever before”. His chart provokes serious questions.

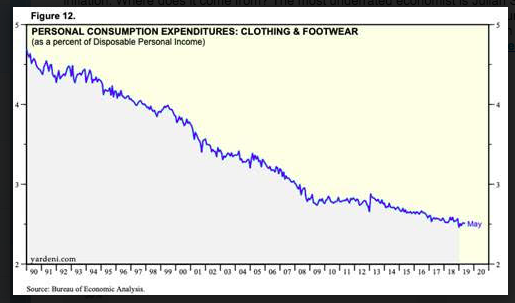

As does Ed Yardeni’s posts that prices continue to trend lower for standard items.

https://www.yardeni.com/pub/pcebudgetshares.pdf

Even so, inflation arises whenever society expands its currency without adding equity. When this occurs, the outstanding equity balance or value which has been created through conversion of invention and innovation into offerings which advance society is dilluted by currency which did not add such equity value. The existing equity balance is then discounted across an expanded base of currency. The only means by which this occurs is government issuance of debt and spending. Government spending rarely adds permanent equity to society. Government spending for war is highly inflationary as it causes production of an array of products and services which not only are consumed in war but leave high levels of debt for which little equity has been created. How does one measure ‘peace’ as a positive outcome when 10s of thousands of lives are lost which is destruction of society’s equity? Big government projects have also proved inflationary, i.e. Great Society, National Highway System, Man on the Moon and etc. The 1970’s “Great Inflation” was the direct result of government spending programs begun in the mid-1960s. It often a factor of government spending in that it needs to be completed in a short period, it often benefits friends of the current political party in power and typically with cost consideration a distant secondary. This is not how one would run a business seeking profits. Governement spending adds currency if it occurs through issuance of debt and it rarely adds equity value. Inflation is the result.

Government is necessary to regulate fair treatment for all citizens and organize defense from outside threats. Bastiat’s view in “The Law”, 1850, is good at delineating the role of governemnt. If only government could operate with some of the principles of successful businesses! If an equity contrbution metric could be developed for government spending, then government spending could be less inflationary. Ideally society’s innovation and the inflationary cost of government should sum to be slightly deflationary.

To access member-only content FREE for 5 days, please follow this link