“Davidson” submits:

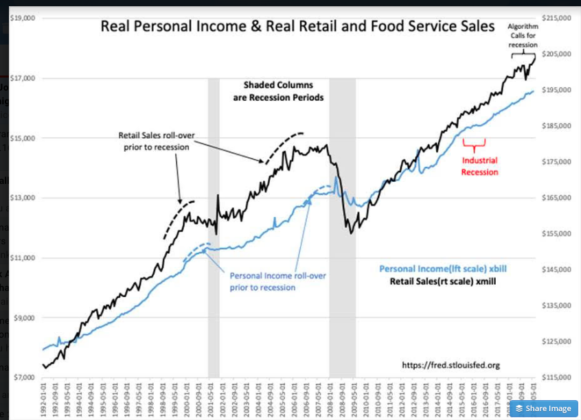

Gradually those voices urging investors to ‘do something’ to avoid the ravages of recession have faded away. There are still a few loud voices, but far fewer than 6mos ago. Real Retail and Food Service Sales reported this morning include several upward revisions and are the highest on record. Real Personal Income for May 2019 is a record high. CNBC continues to focus on economic weakness when very little weakness exists in data.

Investors must always trace a path through the veritable minefield of opinion. Data does not carry emotional or political bias. It is the focus on data which permits investors to plot a sensible investment route. Data helps us not fall victim to the gut-wrenching impact of price volatility driven by algorithms reflecting short-term shifts in market psychology. Algorithms are constructed by those who invest week-to-week when fundamental data evolves over a much longer timeframe. Fundamentals have remained strong the past 18mo in the face of a cacophony of panicked calls for financial collapse and recession. All the data has continued to support economic expansion. Government policy initiatives offer the potential to continue this expansion into new territory especially if we see reduction in global tariffs.

Investing each cycle requires that investors understand that every cycle is unique. Investors must interpret the data in real time and adjust portfolios as it becomes apparent that economic fundamentals shift. Fortunately, fundamentals do not change rapidly but evolve at snails-pace usually providing enough time to make investment decisions. Hindsight is our most valuable tool with which we can spot trends not recognized previously because some trend shifts are initially too subtle to be detected above the noise. The global capital shifts which began in the mid-1990s with the advent of Western investors seeking higher returns in Emerging Markets is one such shift which has boomeranged. The net/net of seeking to monetize Emerging Market assets missed the fact that the fundamental underpinnings of the US Free Market could not be transferred to these markets and the expected performance has not been realized. Missed has been the transfer of Emerging Market capital to Western markets. In monetization process, asset holders took the liquid capital realized to escape the confiscatory tendencies of their own governments. This has resulted in record period of low rates for Sovereign Debt and record prices for real estate. Success lowering global tariffs will continue capital flows to Western nations. In particular, the US having the closest to a Free Market governance structure globally should draw the most of this capital.

I expect US focused portfolios to shortly benefit from improved market psychology. The flow of global capital into fixed income and real estate is likely to continue. Much of Emerging Market capital is inexperienced with historical Western valuation. A review of history suggests that Emerging Market capital is more likely than not to invest with price trends. That is, Emerging Market capital is more likely to be stylistically driven by Momentum Investing than by Value Investing. This evidence is present in the marketplace spanning from the Nikkei of the 1980s culminating in the ‘Japan Inc. Bubble’ of 1990 and numerous periods of over-pricing since. US markets could experience a Momentum Investor driven Bubble should global tariffs decline as capital flows shift more to equity. At present, overt signs of excess market pricing do not exist.

Significantly higher equity prices are ahead in my opinion.

To access member-only content FREE for 5 days, please follow this link