This is an odd economy right now. We have soaring oil and gas prices and a tightening Fed which are rarely positive. We also have surging employment and a falling unemployment rate which are typically positive. This is the reason we’ve seen a manic market the last few weeks as speculators place short-term bets on the market direction with each economic data point. When those data points conflict, you get the large opposite directional swings we’ve seen.

“Davidson” submits:

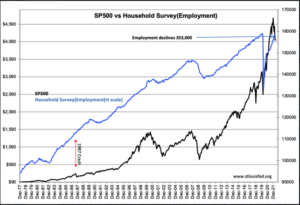

Household Survey declines 353,000, Establishment Survey rises by 428,000, the true story is in the detail.

Excerpts from today’s report:

Establishment Survey:

“Total nonfarm payroll employment increased by 428,000 in April, and the unemployment rate was unchanged at 3.6 percent, the U.S. Bureau of Labor Statistics reported today. Job growth was widespread, led by gains in leisure and hospitality, in manufacturing, and in transportation and warehousing.”

Household Survey Supplemental Data: “In April, 7.7 percent of employed persons teleworked because of the coronavirus pandemic, down from 10.0 percent in the prior month. These data refer to employed persons who teleworked or worked at home for pay at some point in the 4 weeks preceding the survey specifically because of the pandemic. In April, 1.7 million persons reported that they had been unable to work because their employer closed or lost business due to the pandemic–that is, they did not work at all or worked fewer hours at some point in the 4 weeks preceding the survey due to the pandemic. This measure is down from 2.5 million in the previous month. Among those who reported in April that they were unable to work because of pandemic-related closures or lost business, 19.0 percent received at least some pay from their employer for the hours not worked, little different from the prior month.”

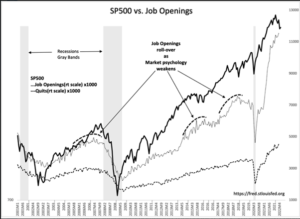

The Job Opening and Quits trends reveal that the underlying details are quite robust. While headlines focus on recession fears as COVID-growth issues are in severe decline, the rest of the economy continues to recover at a strong pace with labor demand so robust that individuals achieving several months of experience can parlay this into higher paying positions at record levels. Every business sector recognized as central to core economic growth i.e., industrial manufacturing, mining, energy production, transportation and etc,., has reported not only surprise quarters but forecast strong demand.

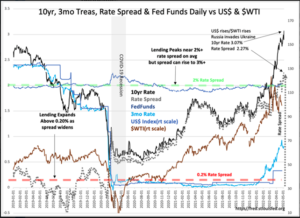

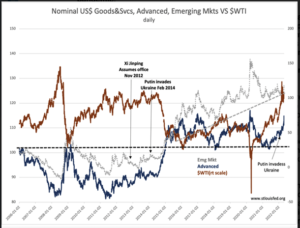

The market continues to be confused as price-trend follower interpret declines in former market stars as signs of recession when no such signs are reported elsewhere. 2 key indicators, the daily T-Bill/10yr Treas Rate Spread and the Nominal US$ are updated.

The Rate Spread continues to widen indicating capital being deployed into business equity for expansion to meet demand. Meanwhile, the US$ has soared indicating capital has since Russia’s invasion of Ukraine sought better opportunities in US markets. Both of these indicators combined represent a very, very positive picture for US markets.