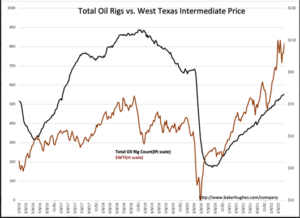

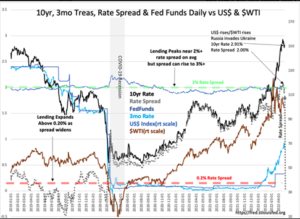

Rig counts continue to rise but there is very little chance oil declines given these dynamics. We are importing more and raiding the SPR to make up the difference…

“Davidson” submits:

There is no acceleration in the pace of rig implementation and similarly no acceleration in production, certainly there is no obvious correlation with $WTI. This morning EOG held its 1Q22 conference call and outlined the efficiencies this well-managed company has achieved. The time to drill a well has dropped to 5days. These are much longer laterals, 25,000ft vs 4yrs ago 4,000ft, and have deployed “Zipper Fracks” with similar improvements towards lowering costs. To fully understand the transition EOG and the industry has made in recent years, one must listen to this call. Link: https://investors.eogresources.com/events-and-presentations/event-calendar/default.aspx

The E&P industry is focused on returning to cash to investors not increasing production. FANG and EOG among others raised dividends, issued special dividends and announced share buyback plans. With production stable, Cash Flows have come from lowered costs.

The US remains in a ~2mil BBL/Day deficit to Domestic consumption with falling inventories and rising imports providing as needed.