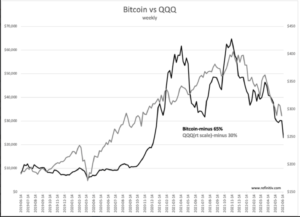

FAR FROM an inflation hedge, bitcoin seems to be more of a highly leveraged QQQ ETF.

While the “blockchain” may have value, bitcoin is a simple money order back by actual currencies. It can never be one with its volatility.

“Davidson” submits:

Bitcoin vs QQQ-both represent price-momentum investor psychology which is deflating. US$ strength last 10yrs indicates a substantial amount of capital has come to the US. These are investors with recent experience in equity markets. The 1st impact was to keep rates low as 10yr Treas are a safe haven and the 2nd was to fuel the long real estate boom prompting a surge by firms like Blackstone under Jonathan Gray to be an aggressive buyer and the largest owner institutionally. Rates of return on assets have fallen from a 1990’s and long-tern 7%-8% range to 3.5% for REITs.

I see too much ownership in too few hands with too much debt on an asset likely in correction today. I see a long and painful correction for these investors who committed capital on price-momentum.

It will impact all asset prices. One has to watch carefully to determine whether risk is economic or simply price due to growing pessimism of momentum investors.