It is not the size of M2 that matters, it is the policies around its expansion and where that capital is directed that matter when it comes to its inflationary effects.

“Davidson” submits:

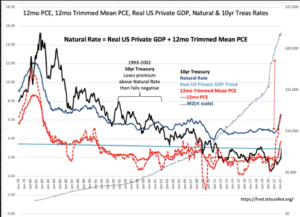

The chart correlates M2/inflation before and after current administration began to reverse and advance policies vs prior administration. It should be clear that M2 which is simply debt issuance of government and business had no impact on inflation prior to Jan 2021. With the new administration Jan 2021 a slew of policies implemented by executive order reversed the prior administration and added new restrictions on corporations.

“Biden rescinded all of Trump’s policies with this Ex Order as best as I can make out. Non-inflationary M2 growth under Trump became massive inflation under Biden. It matters in whose hands M2 landed. Under Trump it went to businesses and individuals who spent judiciously during COVID, under Biden the extra M2 went to states, unions and was geared towards political supporters.

The added M2 likewise was spent differently than the prior administration. Inflation ballooned beginning Jan 2021.

I made the est that 40% rise in M2 would imply 32% inflation over several years. It may not or it may as there may be policy changes should voters change the govt propensity to spend in the mid-terms. But, what should be clear is that M2 as a basis for inflation is not supported. What is supported is change in govt policies i.e., regulations have a huge impact and the impact of regulation is nearly instant.